PNC Bank

Fees

Our Rating

Current Promotion

APY Savings

- Overview

- Pros & Cons

- FAQ

PNC Bank has an extensive history dating back to 1852. Over the last 170 years, this bank has grown to service over 9 million personal and small business customers and become the seventh largest U.S commercial bank.

Today, the bank has over $334 billion in assets, with over 2,000 branches across the Midwest, Southeast, and Mid-Atlantic and a network of approximately 18,000 ATMs. In 2021, PNC acquired BBVA USA, which provided a more national footprint and greater coverage on the western side of the country.

PNC is a full-service bank offering various personal, commercial, and business banking services and products. While PNC does have a decent reputation, many accounts have a maintenance fee, which can be tricky to avoid. This has led to some complaints from previous and current customers.

PNC bank can be a good choice if:

- You’re looking for one stop shop for your finance

- You may need a mortgage/personal loan/home equity loan

- You're looking for long term CDs

- Large Variety of Products and Services

- ATM and Local Branch Network

- ATM Fee Reimbursement

- Strong Online Platform

- Promotions

- No High Yield Savings

- Difficult to Open a Stand Alone Account

- Tricky Waiver Criteria

- Accounts Not Automatically Linked

Can I open a PNC checking account online?

The answer is that you can open a PNC Wallet checking account without going to a bank. You can start the application process by filling out an online form. The PNC team will analyze your application when you submit it and get in touch with you with their approval decision.

Does PNC offer a free checking account?

PNC checking accounts have a monthly maintenance cost, but if you maintain a minimum balance in your linked savings account or receive a minimum amount in direct deposits each month, you may be eligible to have the price waived. These minimums are $500 each for the fundamental Spend checking account, but they are higher for the Performance checking accounts.

Can you close PNC bank account over the phone/online? 50

PNC does make it straightforward and simple to close your account if you decide that it is no longer the best fit for your finances.

The easiest way to close an account is online. You can request an account close through the website chat system. Alternatively, you can call the customer service line and the PNC team member will guide you through the closure process. Finally, you can call into your local branch and the branch staff can affect the closure for you.

Can you buy/invest in gold products via PNC ?

PNC does have an investment platform that allows you to buy stocks, shares and bonds. This means that it is possible to purchase gold stocks to boost your investment portfolio.

The bank has several brokerage account options and you can open one in your local branch or over the phone. The PNC team will go through the applicable charges and fees associated with investing in gold stocks.

PNC Bank Review

Banking Services | Credit Options | ||

|---|---|---|---|

Savings Accounts | Mortgage | ||

Checking Accounts | Government Mortgage | ||

CDs | Credit Cards | ||

Money Market Account | Debit Card | ||

Investing Capabilities | Personal Loans |

Pros And Cons

Of course, no financial institution is perfect and PNC is no exception. There are both pros and cons that will need to be considered before you make a decision about opening an account.

Pros | Cons |

|---|---|

Large Variety of Products and Services | Fees |

ATM and Local Branch Network | Difficult to Open a Stand Alone Account |

Promotions | Accounts Not Automatically Linked |

ATM Fee Reimbursement | Costly Overdraft Fees |

Strong Online Platform | Limited States For High Yield Savings |

- Large Variety of Products and Services

In addition to basic deposit accounts, PNC Bank has a wide selection of products and services from student accounts and student loans to insurance, wealth management and investment options.

This means that you can switch to PNC without worrying about any gaps for your day to day banking.

- ATM and Local Branch Network

PNC Bank has close to 2,600 branches and approximately 18,000 ATMs within its network.

This means that even if you do most of your banking online, you have the reassurance of it being relatively easy to find a physical location if you need it.

- Promotions

if you'd like to make the most of your new bank account, PNC does offer some sign-up bonuses for its deposit accounts. This will depend on the type of account and current offers.

- ATM Fee Reimbursement

Depending on the account you open, you can get ATM fee reimbursement or fees may be waived completely. The reimbursement tends to be set for a specific amount per statement cycle.

- Strong Online Platform

Unlike many banks with a solid physical presence, PNC Bank has developed a strong online platform. You can not only manage your accounts online, but some accounts are incentivized if you open them online.

- Fees

While most accounts have criteria to have your monthly maintenance fees waived, depending on the account, they can be tricky to meet.

- Difficult to Open a Stand Alone Account

As we mentioned earlier, PNC checking accounts are tied into the Virtual Wallet packages. This can make it difficult to open a basic stand-alone checking account.

You will need to take a little time to read through all the Virtual Wallet details to decide if this is a good choice for you or spend some time on the phone trying to open a basic account.

- Accounts Not Automatically Linked

PNC Bank does offer relationship rates, but your accounts won’t link automatically. You’ll need to go into your dashboard and request a link.

- Costly Overdraft Fees

While the fee amounts do vary depending on the type of account you hold, many are above average. This makes it crucial that you read the fine print to ensure that you are familiar with the possible charges before opening your account.

- Limited States For High Yield Savings

The PNC High Yield savings account is not available everywhere to all customers.

PNC Customer Service

You can access a PNC Bank customer support team member at local branches or by phone or online chat. The lines are open to speaking to a representative from 7 am to 10 pm ET Monday through Friday, and 8 am to 5 pm ET on the weekend. You can also tweet the customer service team.

According to the J.D. Power 2023 U.S. retail banking satisfaction study, PNC bank gets very high customer satisfaction in Pennsylvania, NY Tri-state, North Central, and Mid-Atlantic, about average ratings in Illinois, Florida, and lower than average in South Central.

However, for most customer support issues, the app will be sufficient. The PNC Bank app is available on iOS and Android, with high ratings for both platforms. The apps allow you to manage your accounts, pay bills, deposit checks and contact the support team. Using a one-time access code, you can even use the app to access select ATMs without your card.

PNC Bank | |

|---|---|

App Rating (iOS)

| 4.8 |

App Rating (Android) | 4.1 |

BBB Rating (A-F) | A+ |

Contact Options | phone/mail |

Availability | 7 am to 10 pm ET |

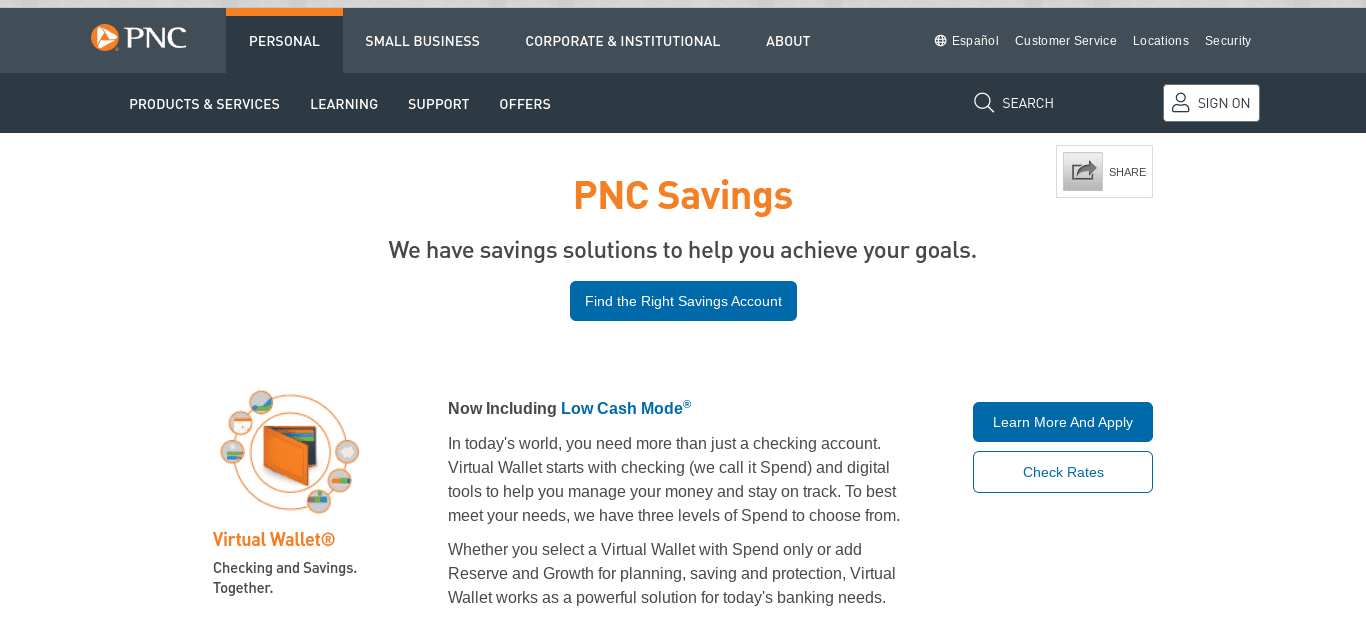

PNC Bank Savings Account

APY Savings

Minimum Deposit

Promotion

Fees

PNC Bank Savings Account

APY Savings

Minimum Deposit

Promotion

Fees

PNC has a number of savings account offerings. These include:

- Standard Savings: As with many large U.S Banks, this account has a relatively low rate, but there is no minimum deposit when you open the account online. (If you open in branch, you need a $0 minimum initial deposit). The account has a monthly service fee, but this can be waived if you’re under 18, link the account to a select PNC checking account, set up an automatic transfer of $25+ per month or maintain an average monthly balance of $300 or more.

- High Yield Savings: This account is only open to eligible customers, so it is not promoted on the main PNC website. It is an online only savings account with a competitive rate and no minimum opening deposit requirements. The account has no monthly service charges.

- Premiere Money Market: PNC has a Premiere Money Market account that has a tiered rate structure depending on your balance and if you qualify for relationship rates. The account allows unlimited deposits and account holders are supplied with a debit card.

- Children’s Savings: PNC also has a savings account geared towards younger children. They can earn interest and access an interactive learning center to teach them about money and banking, with cute Sesame Street characters.

Due to the low rates, PNC is not included in our top savings account list for 2024.

PNC Bank CDs

PNC Bank CDs

APY Range

Minimum Deposit

Terms

Fees

PNC Bank CDs

APY Range

Minimum Deposit

Terms

Fees

PNC Bank CDs have two main types that provide higher rates compared to leaving your money in a standard savings account.

You will need to commit to a set term and this will determine your rate.

-

Fixed Rate CDs

The PNC Bank Fixed Rate CDs have a term of one month to 10 years, with a minimum deposit of $1,000. However, PNC frequently has promotional fixed-rate CDs with a set rate that offers a higher interest rate, as you can see in the following table.

It is possible to withdraw your funds early from a fixed-rate CD, but there are some early withdrawal penalties. The early withdrawal penalty varies from the full amount of interest you would have earned over the full CD term to six months interest depending on how long you have had the CD and the remaining term.

CD Term | APY |

|---|---|

7 Months (Featured) | 0.01% – 0.05% |

12 Months | 0.01% – 0.03% |

13 Months (Featured) | 0.01% – 2.00% |

19 Months (Featured) | 0.01% – 1.25% |

24 Months | 0.01% – 0.03% |

25 Months (Featured) | 0.01% – 1.50% |

24 Months | 0.01% – 0.03% |

37 Months (Featured) | 0.01% – 1.75% |

36 Months | 0.01% – 0.03% |

61 Months (Featured) | 0.01% – 2.00% |

-

Ready Access CDs

If you are not sure about tying up your cash, the PNC Bank Ready Access CD could be a good option. There is only a choice of two standard terms; three months and one year.

However, you only need to commit for seven days. After the seven days, if you experience a financial need, you can access your funds.

PNC Bank Checking Account

Fees

Minimum Deposit

Promotion

APY Checking

PNC Bank Checking Account

Fees

Minimum Deposit

Promotion

APY Checking

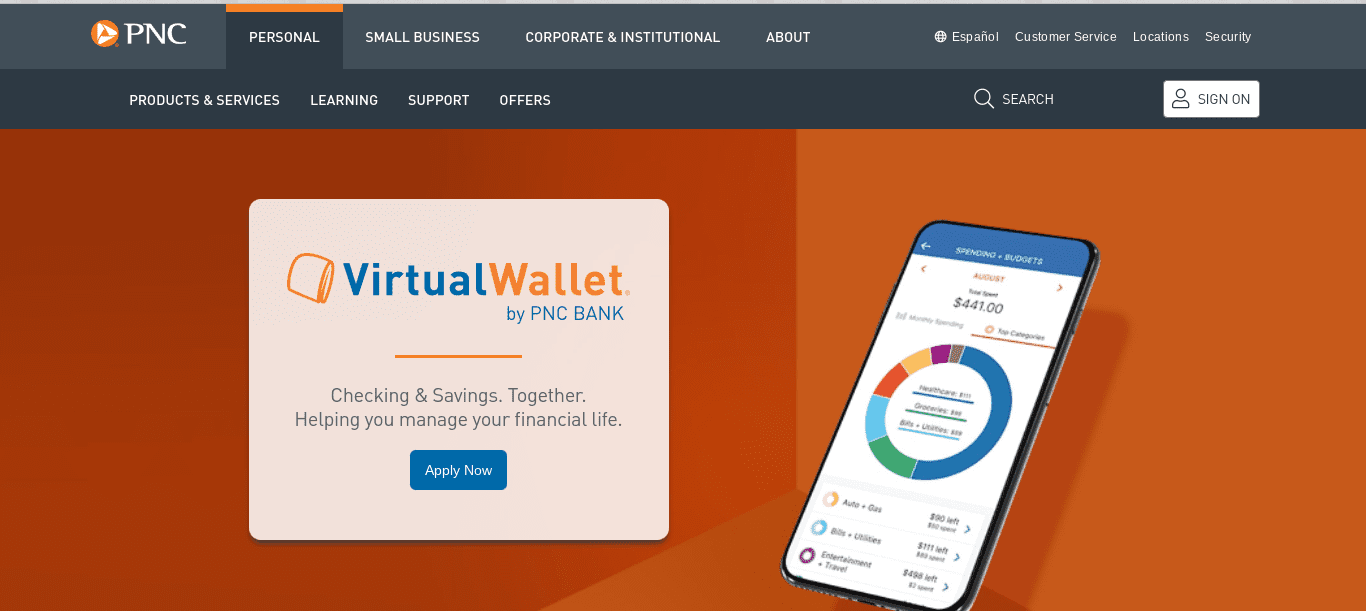

The main PNC Bank Checking account offering is its Virtual Wallet, which is one of the best bank accounts to open if you are looking for a virtual account.

-

PNC Virtual Wallet

Similar to products such as Ally online checking or SoFi bank, this is actually a package of accounts that are designed to work together to make your banking simple.

- Spend: This is the PNC Bank regular checking account, which could be interest earning depending on your Virtual Wallet package. The minimum to open this account is $25, but this minimum is waived if you open the account online.

- Reserve: This is an interest-bearing checking account that requires at least $1 in the account to earn interest. It is designed to help you with short-term savings goals, but you can still access the funds as you need them.

- Growth: This is for your longer-term savings, but there are no minimums to open this account.

The Virtual Wallet has a monthly maintenance fee of $7, but this can be waived in a number of ways including:

- Maintaining a $500 combined monthly average balance across your Spend and Reserve accounts.

- Making $500 or more direct deposits to the Spend account per month

- If you’re aged 62 or older.

This account package provides up to $5 in reimbursements for ATM surcharges per statement period if you use non-PNC bank machines.

-

Virtual Wallet with Performance Spend

This package has the same opening requirements as the basic Virtual Wallet, but a $15 monthly maintenance fee applies unless you have an average monthly balance of $2,000, have $2,000+ direct deposited to your spend account or have $10,000+ average monthly balance combined across all your PNC consumer accounts.

The Virtual Wallet with Performance Spend not only provides access to higher rates on your funds, but you can get up to $10 in reimbursements for ATM surcharges per statement period.

-

Virtual Wallet with Performance Select

This package has a higher service fee of $25, and the requirements to waive this charge are also higher.

However, you can enjoy an interest bump on your Reserve account balance and receive up to $20 in out-of-network fees if you use a non-PNC ATM each month.

-

Virtual Wallet Student

PNC Bank also offers a Virtual Wallet Student package that offers some nice perks including one free wire transfer per statement period and no monthly maintenance fee.

PNC Lending Products: Full Package

PNC has a full complement of banking products including lending products. These include:

-

Credit Cards

PNC has a great selection of credit card options. One of the most popular is its Cash Rewards Visa, which has tiered rewards for up to 4% cash back on purchases. The PNC Core credit card is better suited for balance transfers as it has a 0% APR intro rate for 12 billing cycles.

The PNC Core® Visa® Credit Card offers savings through low rates. Benefit from an introductory 0% APR on purchases and balance transfers for the first 15 billing cycles.

Another card worth mentioning is the PNC points® Visa® Credit Card ,where you can earn 4 points for every $1 in purchases and redeem with rewards including cash, travel and more

However, even if you have less than ideal-credit, you still have a PNC credit card option. The PNC Secured card provides a credit limit according to your deposit of up to $2,500. Your payment activities are reported to all the credit bureaus to help you to rebuild your score.

-

Mortgages

PNC offers home loans for purchasing a property or refinancing your home. These include fixed rate, variable rate, FHA and VA loans along with jumbo loans. PNC also offers specialized loans for scenarios such as 80-10-10.

However, what makes PNC quite unique is that you can apply online and lock in your rate. You can also use electronic verification to save time during the application process.

-

Loans

PNC has a variety of loan options, including personal loans, auto loans, and lines of credit. The loans are fixed rate and have no prepayment penalties, with a maximum of $20,000 for personal loans.

The lines of credit have a variable rate but offer the potential to borrow up to $25,000.

How to Open PNC Bank Account?

As we touched on above, you can open most accounts with PNC Bank via its website. When you visit the official site, you’ll see information for most of its products and services. You can then click on the “Learn More and Apply” button.

You’ll need to confirm your zip code and then you’ll be redirected to a product page. Once you’ve read through the details and are happy to proceed, click the “Apply” button.

From this point, the process is fairly standard. You’ll need to complete an application form with your personal details including your full name, address, contact details and Social Security Number. If you have already applied for a bank account online with another bank, this process should feel quite familiar.

At the end of the application form, when you click submit, PNC will evaluate your application and provide you with an approval decision. This is usually almost immediately, but in some cases, you may need to wait a day or two.

Conclusion: Does PNC Bank Worth It?

The PNC Bank product selection can be confusing, particularly when looking at checking accounts and the Virtual Wallet. Additionally, the confusion can be heightened since some products are only available in select markets. It is possible to open a stand-alone account, but you need to delve deeper into the website or speak to a branch representative or phone representative.

PNC Bank’s rates are competitive, but if you’re looking to open a savings account, there are many online-only banks that offer better rates. However, you will need to forgo the reassurance of accessing a local branch.

FAQ

What promotion does PNC offer?

PNC offers Up to $400 for new account, based on deposits they receive in the first 60 days. Open a base Virtual Wallet account and receive $500/$2,000/$5,000 or more in monthly direct deposits within 60 days to earn a $50/$200/$400 bonus. The offer is expired on N/A

When it comes to credit cards, the bank offers $100 or $50,000 bonus points on selected credit cards. However, to qualify for the bonus, you need to apply through the link on the PNC product page and meet the eligibility criteria.

Is PNC can fall for recession?

PNC has been operating for over 150 years, so it has a long track record of navigating tough economic times. During the 2007/2008 financial crisis, PNC did receive $7.6 billion in federal bailout funds. However, by 2010, the bank had repaid these funds.

Additionally, the bank is FDIC insured, so even if a recession hits and the bank starts to struggle, customer deposits of up to $250,000 are insured.

Can you buy/invest in Crypto via PNC?

PNC has partnered with Coinbase Global, which is a cryptocurrency exchange platform to make it easier for its customers to buy, sell and store crypto coins.

You’ll need to phone the PNC helpline or visit your local branch to find out the fees and charges, and whether you need to upgrade your investment account to be able to invest in crypto.

Is PNC worth it for Millenials?

PNC offers a good balance of products with convenient access that is ideal for millennials. Unlike many millennial friendly banks, PNC has a branch network. So, while you have the convenience of online access and app account management, you can also call into your local branch if you have a query you’re struggling to resolve.

The Virtual Wallet platform is a great option for millennials, as you can link your savings and checking accounts for maximum functionality.

Alternatives

APY Savings

The annual percentage yield (APY) is a percentage that represents the amount of money or interest earned on your savings account over the course of a year. The APY factored in compound interest. A savings calculator can help you quickly determine how much you'll earn with a given APY.

| 4.50%

| 4.25%

| 0.01%

|

Checking Account Fee

The monthly fee on checking account

| $0 | $0 | $12

Can be waived if you maintain a $1,000 minimum daily balance, making direct deposits or Associated SnapDeposits of $500 or more per statement cycle, or holding $2,500 in combined deposit accounts with the same statement cycle date or having a Health Savings Account or investment account

|

Checking Minimum Deposit | $100 | $0 | $0 |

Mobile App Rating | 4.5/5 on iOS, 3.4/5 on Android | 4.9/5 on iOS, 4.7/5 on Android | 4.8/5 on iOS, 4.3/5 on Android

|

BBB Rating | A+ | A+ | B- |

Compare PNC With Other Banks

Chase has some great features including a massive selection of credit card options. Both banks also offer some great mortgage packages. PNC also has some innovative credit card options, and you can also access personal loans.

Read Full Comparison: Chase vs PNC Bank: Which Bank Account Is Better?

The Wells Fargo service is even more extensive. Checking accounts, various savings accounts, mortgages, loans, and investment options such as IRAs, 401ks, and wealth management solutions are all available.

PNC offers checking and savings accounts, home loans, mortgages, investments, student loan refinancing, and a variety of credit cards.

Read full comparison: Wells Fargo vs PNC: Which Bank Account Wins?

Bank of America and PNC Bank offer various banking products, but which is a better fit for you? Let's compare and see our winner: PNC Bank vs. Bank Of America

PNC Bank and Citibank are two big players in brick-and-mortar banking. Let's compare them side by side and see which is our winner: PNC Bank vs. Citibank

PNC is our winner in this competition with a better banking package than Huntington Bank. But there are more things to consider: PNC Bank vs. Huntington Bank

While PNC offers better savings rates than U.S. Bank, the latter has better credit cards. Which is best for bank account? Here's our verdict: U.S. Bank vs. PNC Bank

PNC Bank and Fifth Third Bank are two big players when it comes to brick-and-mortar banking. Let's compare them and see which is our winner: PNC Bank vs. Fifth Third Bank

We prefer PNC Bank over M&T, mainly due to higher savings and money market account rates and better credit cards. Here's our comparison: PNC Bank vs. M&T Bank

Our winner is PNC Bank as it offers more options for checking and higher savings rates than Truist bank. Here's our comparison: Truist Bank vs. PNC Bank

Both KeyBank and PNC Bank are active in various states, such as Pennsylvania, Indiana, Ohio, and more. Let's compare their banking products.

While the differences are insignificant, our winner is PNC Bank, which has better options than BMO Bank. Here's our complete comparison: PNC Bank vs. BMO Bank

PNC and Regions Bank operate in several states, including Florida, Georgia, Kentucky, and South Carolina. Let's compare them side by side: Regions Bank vs. PNC Bank

While PNC Bank is a brick-and-mortar bank, Capital One's presence is mainly online. Let's compare them and see which is our winner: Capital One vs. PNC Bank

While PNC Bank is a brick-and-mortar bank, American Express Bank's is an online bank. Let's compare their banking products side by side: American Express Bank vs. PNC Bank

PNC Bank is our winner with a complete package of banking services. SoFi is best for savings rates, online experience, and lending options.

The Smart Investor Banking Reviews: Methodology

The Smart Investor team extensively reviewed hundreds of banks and credit unions. We assessed them based on four main categories, each with specific features:

-

Diversity of Products and Their Attractiveness (40%): We extensively analyzed the breadth and appeal of each bank's product offerings, including savings accounts, checking accounts, loans, investment options, and more. Higher ratings were assigned to banks with a diverse range of products that are attractive in terms of interest rates, fees, terms, and additional features. This category provides insights into the variety and value of the bank's offerings, crucial for meeting customers' diverse financial needs.

-

Account Features (30%): This category delves into the features and benefits accompanying each bank's accounts. We scrutinized factors such as promotions, deposit and withdrawal options, ATM accessibility, online and mobile banking functionalities, as well as additional perks like overdraft protection and rewards programs. Banks offering comprehensive and convenient features received higher ratings, reflecting the overall value of their accounts to customers.

-

Customer Experience (20%): A positive customer experience is paramount in banking, so we evaluated each bank's performance in this area. This included assessing the ease of account opening, quality of customer service, availability of support channels, and overall user satisfaction. Ratings were based on factors such as responsiveness, efficiency, and the bank's commitment to meeting customer needs, ensuring a seamless and satisfactory banking experience.

-

Bank Reputation (10%): The reputation of a bank is a critical consideration for customers. We examined factors such as financial stability, regulatory compliance, and public perception to determine each institution's overall trustworthiness and reliability. Higher ratings were awarded to banks with strong reputations, reflecting their credibility and ability to inspire confidence among customers.

By considering these categories, individuals can make informed decisions that align with their financial needs and preferences, ensuring they choose a bank that offers competitive products, excellent features, a positive customer experience, and a solid reputation.

Compare PNC Bank Savings

PNC offers higher savings rate than Discover, but the states are very limited. Here's our full savings account comparison: Discover Online Savings Account vs. PNC Standard Savings

PNC offers much higher savings rate than Chase, but PNC states are very limited. Here's our full savings account comparison: Chase Savings vs PNC Standard Savings

Sign Up for

Our Newsletter

Banking Reviews

Alliant Credit Union Review