Table Of Content

Savings are a crucial part of financial stability. Whether you have an emergency fund or investment funds, savings can provide security against unforeseen events or situations. As you can see in this chart using FED Survey of Consumer Finances data, Americans are saving more.

What Is A Savings Account?

When we talk about a savings account, we’re talking about an account with your bank that lets you deposit money and leave it there while earning interest. Any bank, credit union, or other financial institution that offers these types of accounts is insured by the FDIC, and they pay you interest.

A savings account is considered a time deposit. That means your bank is allowed to limit your ability to take money out, like requiring notice or charging a penalty.

You generally won’t find banks that do this, but you may find ones that will tell you that your number of transactions on a savings account is limited by the month. On top of that, they may charge you fees, and they usually aren’t going to give you checks for a savings account.

How Are Savings Account Rates Determined?

This depends on the deposits being made and how many people are using and valuing the savings account services. They can raise interest rates if they are extra deposits or more money than usual.

They also have to compete with bonds and money market accounts, so they will need to offer comparable rates to stay in business and ensure they have customers who want to use their savings account services.

When interest rates decline at the Federal Reserve, banks will also have to lower their interest rates for their savings accounts, so they don’t lose money.

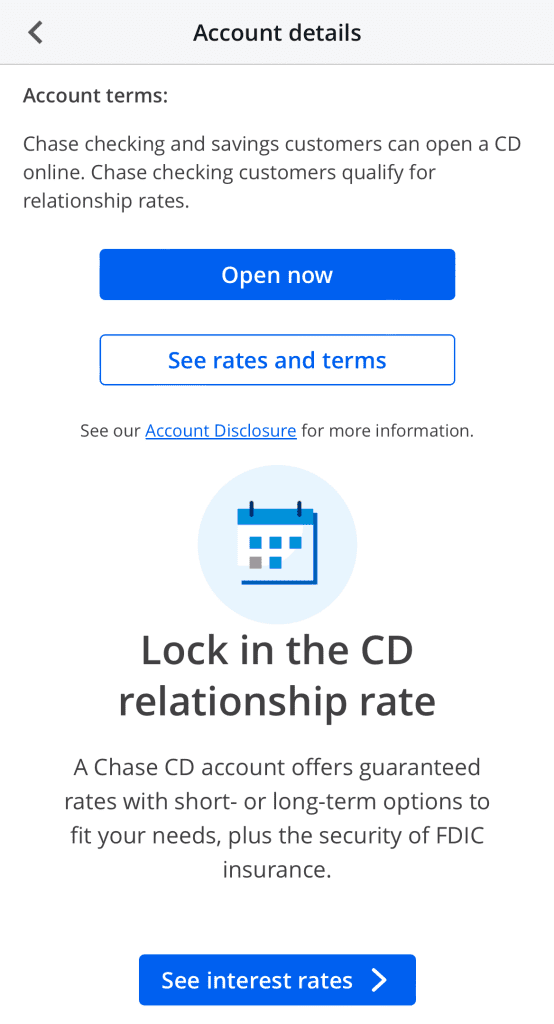

What are Certificates of Deposit (CDs)

CDs are another form of a time deposit, but in a slightly more restrictive form than with the savings account. You agree to keep the money settled in a specific account for some time (generally six months, 18 months, one year, etc.)

If you agree to a longer term, you’ll generally get a better interest rate. In addition, you’ll usually find that the APR is fixed, meaning it stays the same for the entire term.

We’ll look at some exceptions to these rules, but generally, your CD will ‘mature’ at the end of the term you agreed, and you get to decide how you want to proceed. The bank will usually tell you you have choices as you get close to this point. If you choose not to act, you may end up with the money cycled into a new CD of the same term.

The Differences: CDs and Savings Accounts

While both CDs and savings account goal is the same – the way they work is different. Before committing to any of these – it's good to make sure you understand the main differences between them.

CD | Savings Account | |

|---|---|---|

Term | 3 -120 months | Anytime |

Minimum Balance | Up to $5,000 | $0 – $50 |

Interest | 4-5% APY | 3-4% APY |

Withdrawal Restrictions | Penalty If You Withdrawal Before Maturity | 3-6 per month

|

Fees | None | None Or Very Low |

Protection | Up to $250,000 per account holder | Up to $250,000 per account holder |

-

CDs Bump Up Your Interest

With a CD, you will have a better interest rate if you agree to leave your money in the account for a longer period. In fact, with a 3-5 year agreement, you could get above 1-2% more than the rate you get in your savings account.

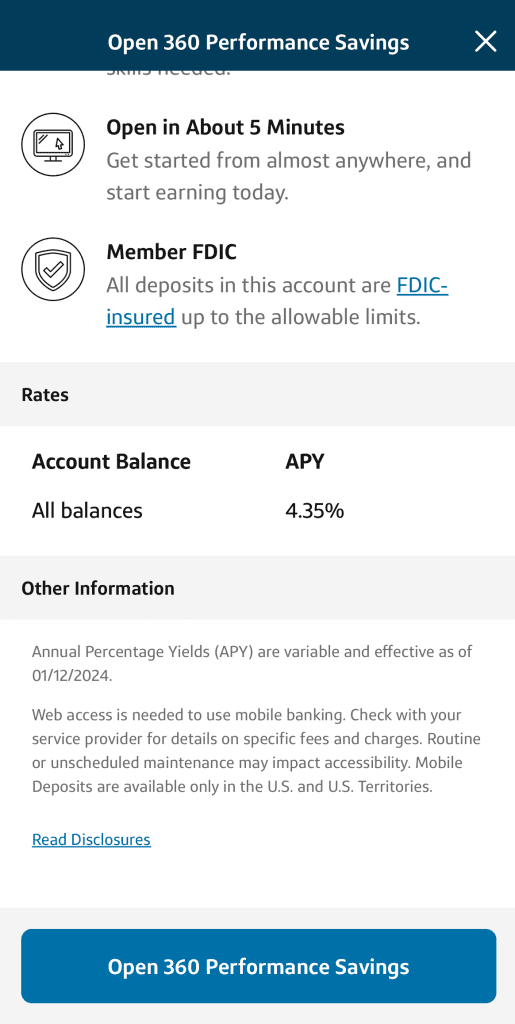

When it comes to savings accounts, you’re generally not going to get a great rate, but you’ll be able to get some extra money from interest. You want to make sure you look at what’s out there to see if you’re getting the best rates.

Financial Institution | Savings APY | CD APY |

|---|---|---|

American Express

| 4.30% | Up to 4.75% |

Marcus

| 4.40% | 4.00% – 5.05% |

Capital One

| 4.35% | 4.00% – 5.10%

|

Discover Bank

| 4.25% | 2.00% – 4.70%

|

Quontic | 4.50% | 4.30% – 5.30% |

UFB Direct

| Up to 5.25% | / |

Ally Bank

| 4.25% | 3.00% – 4.50% |

TIAA Bank

| 5.15% | 3.95% – 5.15% |

Most banks offer higher interest rates on CDs because you have to keep the money in the account before you are allowed to withdraw it. You will agree on the term with the bank when you sign the papers and deposit the money. If you want a higher rate, you should choose the longest term.

Make sure it’s a term you will be okay with not having your money though. If you withdraw the money and face penalty fees before your term is up, you might end up losing much of the interest you earned in the first place.

-

Savings Accounts Are More Flexible

When it comes to a savings account, the Federal Reserve Board’s Regulation says that banks are only allowed to give you a maximum of 6 withdrawals from either a savings account or a money market account in a month. These actually apply to several different types of transactions but not to withdrawals that are made through an ATM or through an in-person visit.

When you look at CDs, however, you have to agree to leave the money in the account for the full period. There are no withdrawals allowed without incurring a penalty. That penalty amount could vary, but it’s usually based on the time passed from the date you opened the account.

-

Savings Accounts Fees Are Higher

Fees are also different between savings accounts and CDs. Savings accounts often have higher fees than CDs, but it depends on the institution.

For example, some institutions don't charge monthly maintenance fees for a savings account with a balance higher than a couple of thousand of dollars.

-

CDs Minimum Deposit Is Higher

Most CDs require a minimum deposit, while the savings account the minimum deposit is usually smaller.

Here's a comparison of minimum deposit needed at some of the most popular financial institutions that offer savings accounts and CDs:

Financial Institution | CD | Savings Account |

|---|---|---|

American Express

| $0 | $0 |

Marcus

| $500 | $0 |

Capital One

| $0 | $0 |

Chase Bank

| $1,000 | $25 |

Discover Bank

| $2,500 | $0 |

Quontic | $500 | $100 |

CIT Bank | $1,000 | $100 |

Ally Bank

| $0 | $0 |

Citi Bank

| $500

| $0

|

How to Decide Between Them?

There are a couple of different things to keep in mind when you’re looking at whether to get a savings account or a CD.

- Do you need the money soon? If you will then a CD is not the way to go because you’ll have a set period where you can’t get it.

- What type of investment do you need, long-term or short-term?

- Are you looking for the highest profit with less flexibility or the lower profit with more flexibility?

If you aren’t going to need your money then a CD is a good way to go. Instead of the no-interest checking account, you might otherwise use, this is going t ogive you some pretty good yield.

If you have money and you have enough patience to wait around you can actually use a CD ladder to get the most for your money.

If you want money available for emergencies and you want to have access to your money you’ll probably want a savings account instead.

Where To Open Savings Accounts And CDs?

CDs and savings accounts can be opened at traditional brick-and-mortar banks and credit unions. These financial institutions have physical locations where customers can visit to open an account and conduct other banking transactions.

Credit unions offer CDs, but they call them to share certificates. They essentially work the same though. They have terms that range from several months to years. The minimum deposit and the terms and conditions will vary by the institution and the CD that you choose.

Credit unions will often offer more than banks. Small credit unions still have branches and ATMs, so you can visit them in person and commit to a time period of what you want your CD to be.

In addition to traditional banks and credit unions, many online-only banks also offer CDs and savings accounts. These banks operate primarily or exclusively over the internet and typically offer higher interest rates than brick-and-mortar banks.

Many online-only banks are FDIC insured and have the same security measures as traditional banks, but keep in mind that some online banks may have limited customer service options or may not have physical branches.

When looking to open a CD or savings account, it is important to shop around and compare the interest rates, fees, and other terms offered by different banks and credit unions. This can help you find the best account for your needs and ensure that you earn the most interest on your savings.

Sign Up for

Our Newsletter

How Much Money to Keep in a Savings?

Calculating your savings potential and estimating how much you should save can be done by using your age. Remember to not get discouraged if it's too late. It is possible to get back on track.

First, there is no one-size-fits all solution. Your savings and goals should be matched to your lifestyle. This includes everything, from how you shop to where you live to if your kids are grown, whether you rent, or have a mortgage. Each person has their own magical number, based on their financial situation.

Specific savings goals can help you find your magic number. You can set a goal for how much you save. For example, if you open a savings account to pay for a vacation, a house purchase, or a wedding, then the amount that you keep in it will be determined.

You might need $5,000 to go on a vacation, $15,000 to buy a new car, or $20,000 for education. However, emergency funds are not limited to a specific amount you should aim at.

Because everyone has different needs for a rainy day fund, how much cash should you have in savings or money market accounts for emergency situations?

Financial experts recommend that you keep three to six months of your monthly expenses in emergency savings. If your monthly expenses are $3,000 then you should have between $9,000 to $18,000 in an emergency savings account or money market account. This will allow you to be ready for when you need it.

FAQs

When should you get a CD?

You should get a CD if you want to earn high interest in your money and know for sure that you won’t need access to it in the near future. There are high penalty fees for withdrawing money early out of a CD.

Putting your money into a high-yield savings account will allow you to earn more over the long term and give you something to look forward to when you withdraw the money after your term has ended.

When should you get a savings account?

You should get a savings account if you want to tuck some money away for the future. Savings accounts work best for people that are saving for the near future and need just a little money to keep in a safe place.

They are good for emergency funds and offer you a way to get fast cash if you need to make car repairs, pay medical bills, or do anything else.

What do Banks Do with the Money in my Savings Account?

If you put money in a savings account, you are basically lending the bank money. They will borrow some of the money every time they have to give out a personal loan, an auto loan, or a home loan.

If they use your money to give out a loan, they will charge higher interest on the loan than what they pay you for on your account. This allows them to make a portion of their money back. The difference in interest that they charge is how banks stay in business.

How much interest will I earn on $10,000 in a savings account in a year?

This is determined by the APY on your savings account. Some savings accounts have a higher yield than others, which means they earn more interest.

If you put $10,000 in a savings account with a 0.5 percent APY, you will earn about $50 per year.If you put your money in a high-yield savings account, you could earn $5 or more over the course of a year.

Where should I put my money to earn the best interest rate?

If you have a large sum of money, putting it in the right place can allow you to earn the highest interest rate possible, allowing you to have even more money by the end of the year. Both high-yield savings accounts and checking accounts can earn you interest, but they aren't your only option.

Look for checking accounts that offer sign-up bonuses and additional interest for the first year of banking. Money market accounts typically pay slightly higher interest rates than savings accounts. If you don't think you'll need any of your savings, you can open a CD. They pay the highest interest, but there are significant fees if you want to withdraw some of the money.

Is it possible to lose money in a CD account?

In most cases, it is impossible to lose money in a CD account. Like any other banking deposit, your bank or credit union deposit is insured by the Federal Deposit Insurance Corporation (FDIC).

However, in case of high inflation, your money loses buying power. If you deposit $100,000 with 4% interest rate and the inflation is 7%, you lose 3% of your money buying power every year.

Sign Up for

Our Newsletter