Rewards Plan

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

Welcome Bonus

Our Rating

Intro APR

Annual Fee

APR

- Welcome Bonus

- High Rewards Rate

- Annual Fee

- Not Ideal for Non-Travel Spending

Rewards Plan

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

Welcome Bonus

Our Rating

PROS

- Welcome Bonus

- High Rewards Rate

CONS

- Annual Fee

- Not Ideal for Non-Travel Spending

APR

22.49%–29.49% variable

Annual Fee

$550

0% Intro APR

N/A

Credit Requirements

Excellent

- Our Verdict

- FAQ

The Chase Sapphire Reserve Credit Card is a premium travel card offering substantial benefits and rewards for frequent travelers.

The card's pros include a high rewards rate, luxury perks, premium travel protections, transfer partners, and primary rental car coverage. The elevated rewards include

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

.Additional perks encompass a $300 annual travel credit, access to over 1,300 airport lounges globally, 50% boost in travel redemption value and a statement credit for Global Entry, NEXUS, or TSA PreCheck applications. The card also offers trip cancellation/Interruption insurance and other travel-related benefits.

However, there are cons to consider, including the high annual fee and the necessity to have excellent credit. The rewards system has limitations, requiring purchases through the Chase portal for the highest rates, potentially limiting choices for users.

How hard is it to get a Sapphire Reserve card?

It is harder to get this card than some of the other Chase credit cards. However, if you have a credit score of at least 720 then you will be in with a good chance of getting approval.

What purchases don't earn cash back?

All purchases will earn you cashback with this card. This means that it can be nice and predictable when you are using it for everyday purchases.

What are the top reasons NOT to get it?

You do not travel a lot or you don’t want to pay the large annual fee. Those people who travel a lot can earn some stunning rewards from these types of cards.

In This Review..

Pros and Cons

Let’s take a look at the pros and cons of the Chase Sapphire Reserve card:

Pros | Cons |

|---|---|

$300 Annual Travel Credit | Annual Fee |

Generous Sign-up Bonus | Requires Excellent Credit |

No Foreign Transaction Fee | Not Ideal for Non-Travel Spending |

50% More Ultimate Chase Rewards | |

Premium Travel Protections | |

Transfer Partners | |

Airport Lounge Access | |

TSA Precheck or Global Entry Reimbursement | |

Primary Rental Car Coverage |

- $300 Annual Travel Credit

Cardholders receive an automatic $300 statement credit annually for travel purchases, covering a wide range of expenses including taxi rides, campground fees, and train fares.

- Generous Sign-up Bonus

The card offers a substantial sign-up bonus of 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

- No Foreign Transaction Fee

Chase Sapphire Reserve has no transaction fee while traveling in other countries. Many other cards have fees when you make purchases outside of the United States.

- 50% More Ultimate Chase Rewards

Your points go further when you book through Ultimate Chase Rewards. These rewards include all things travel-related, such as flights, hotels, cruises, and car rentals.

- Premium Travel Protections

The card provides essential travel protections such as Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, and Lost Luggage Insurance, enhancing the overall travel experience.

- Transfer Partners

Users can transfer points at a 1:1 ratio to leading airline and hotel loyalty programs, providing flexibility and potentially enhancing the value of their rewards.

- Airport Lounge Access

You can have access to exclusive airport lounges with the Priority Pass Select membership that comes along with being a Chase Sapphire Reserve card holder. This membership is a $399 annual value.

- TSA Precheck or Global Entry Reimbursement

The Chase Sapphire Reserve card will reimburse your application fee for TSA Precheck or Global Entry once every four years. This cost is usually around $85 to $100.

- Primary Rental Car Coverage

The card offers primary rental car coverage of up to $75,000 for theft and collision damage, providing peace of mind for travelers renting vehicles.

- Annual Fee

Chase Sapphire Reserve has a high $550 annual fee. Many other credit cards do not have annual fees. This fee can be offset with the annual travel reward bonuses. There is a annual fee for each authorized user.

- Requires Excellent Credit

To qualify for the card, applicants need an excellent credit score ranging from 720 to 850, limiting its accessibility to a specific demographic.

- Not Ideal for Non-Travel Spending

For individuals who do not frequently spend on travel and dining, the card may not provide significant value, and a more versatile cash-back card might be a better fit.

Top Offers

Top Offers

Top Offers From Our Partners

Rewards Simulation: How Much You Can Earn?

The best way to see if the Chase Reserve Card is the right choice for your needs, is to calculate the amount of rewards and benefits you suppose to earn.

Keep in mind that this is a general breakdown of expenses, so make sure to adjust it to your own consumer preferences and spending habits.

| |

|---|---|

Spend Per Category | Chase Sapphire Reserve |

$15,000 – U.S Supermarkets | 15,000 points |

$5,000 – Restaurants | 15,000 points |

$4,000 – Hotels | 40,000 points |

$3,000 – Airline

| 15,000 points |

$4,000 – Gas | 4,000 points |

Total Points | 89,000 points |

Estimated Redemption Value | 1 point ~ 1 – 1.5 cents |

Estimated Annual Value | $890 – $1,335 |

What Can I Do With Chase Points?

The Chase Sapphire Reserve offers various redemption options for the points earned through its rewards program, Chase Ultimate Rewards. Here are the primary redemption options:

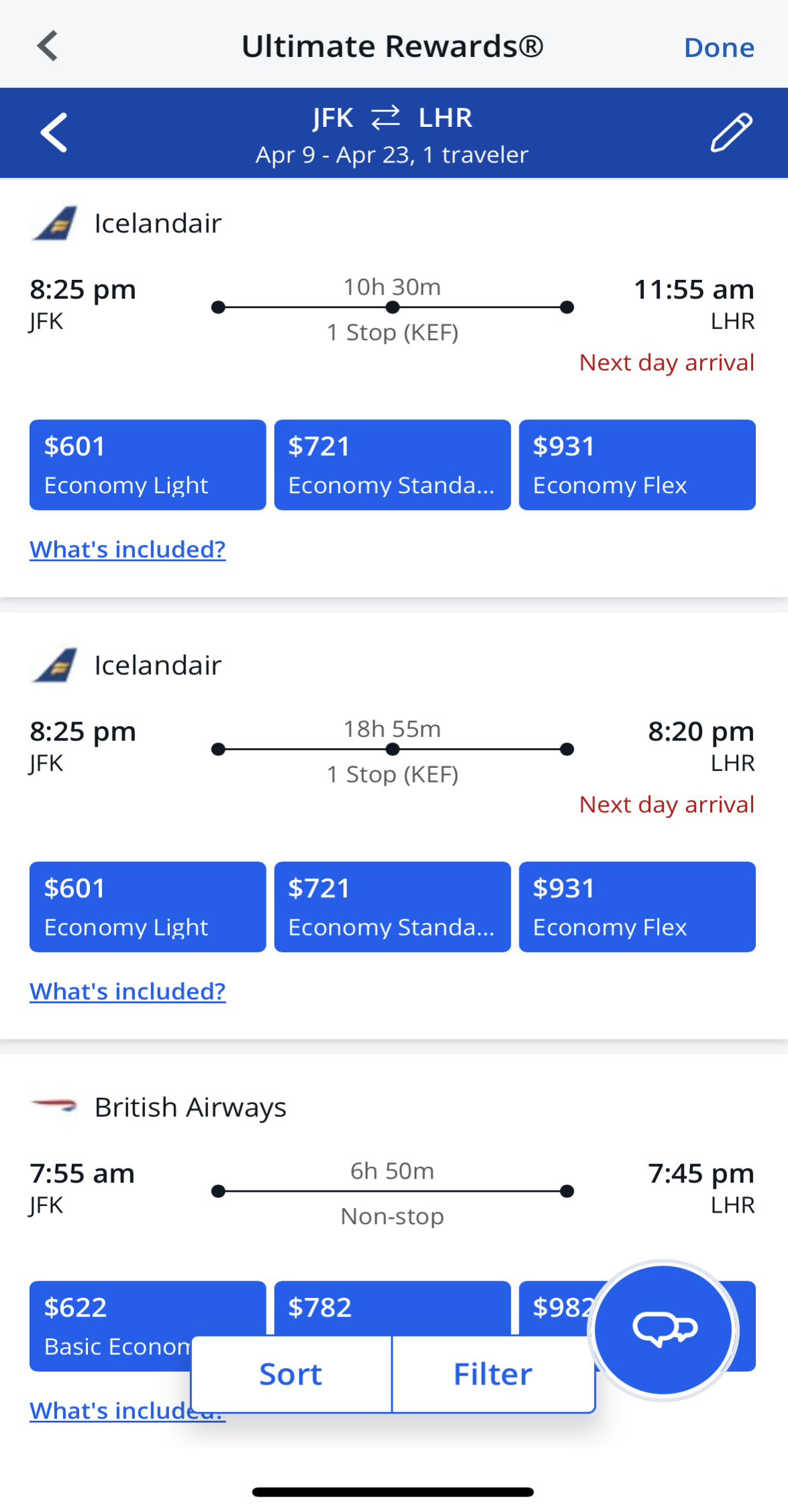

Travel Through Chase Ultimate Rewards: Cardholders can redeem points for travel, including flights, hotels, car rentals, and more, through the Chase Ultimate Rewards portal. Points redeemed for travel in this way are valued at 1.5 cents each, providing an enhanced value compared to other redemption options.

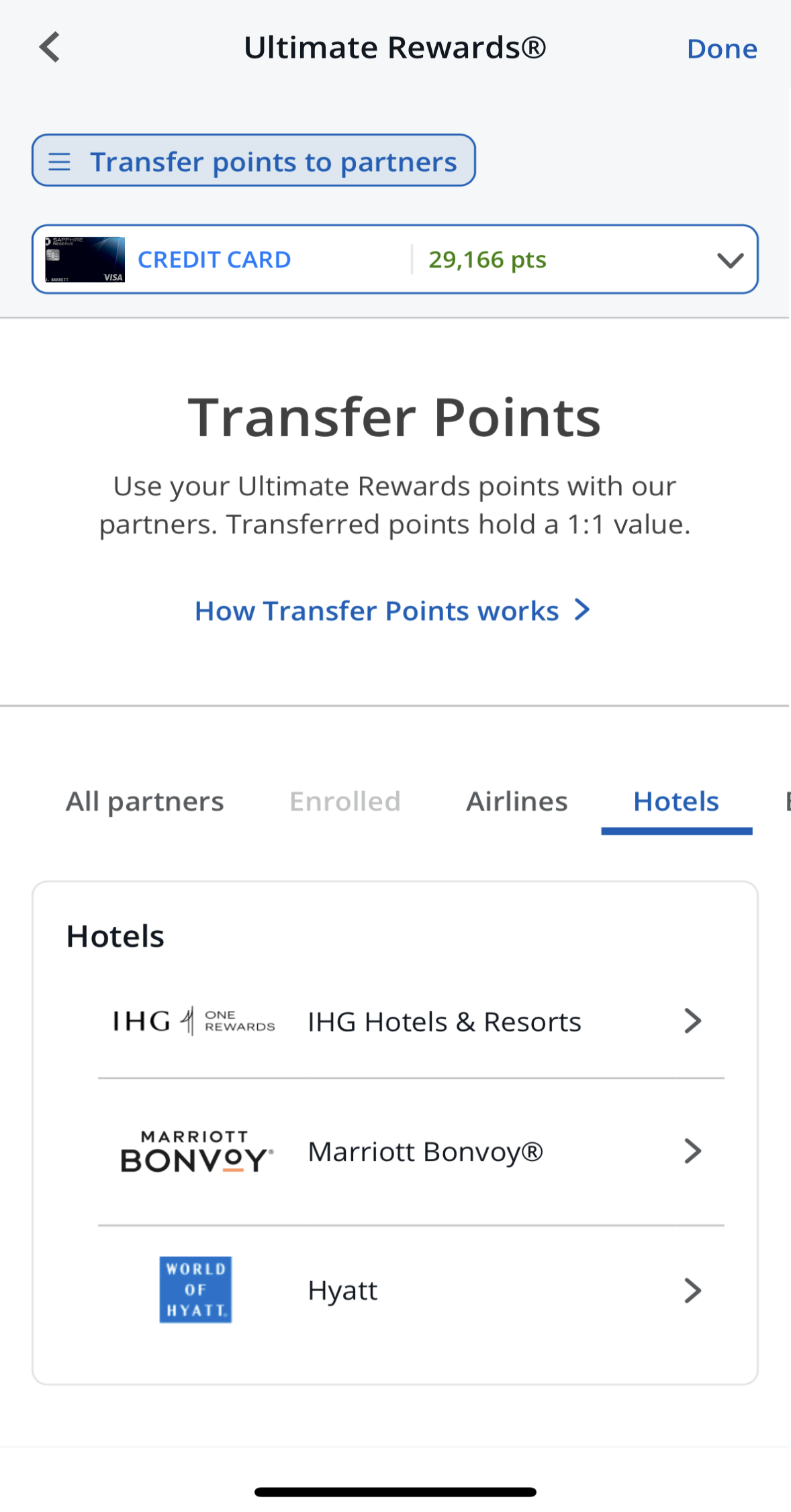

Transfer to Airline and Hotel Partners: Points can be transferred at a 1:1 ratio to several leading airline and hotel loyalty programs. This allows cardholders to potentially maximize the value of their points by using them for specific airline miles or hotel stays.

Cash Back: Points can be redeemed for cash back as a statement credit or direct deposit into a checking or savings account. However, the cash-back value may be less than the value obtained through travel redemptions.

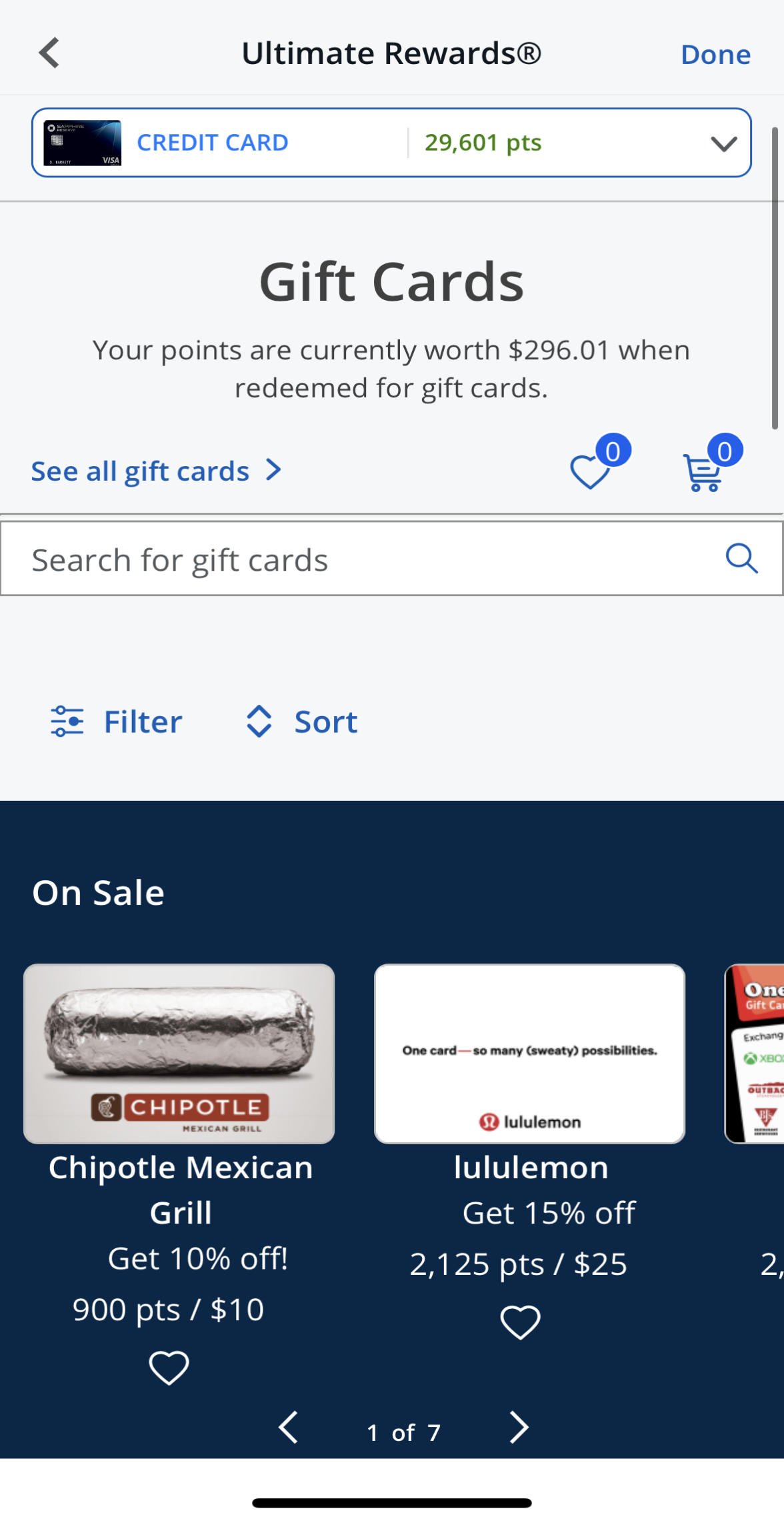

Gift Cards: Points can be redeemed for gift cards from a variety of retailers and brands. The value per point may vary depending on the specific gift card.

Shop with Points: Cardholders can use points to shop at participating retailers, either directly through the Chase Ultimate Rewards portal or by linking their card to select merchants.

Pay Yourself Back: This feature allows cardholders to redeem points for statement credits against eligible purchases in categories like dining, grocery stores, home improvement stores, and select charities.

How To Make the Most of the Chase Reserve Card?

The Reserve card is not a cheap card, but it offers a bunch of premium benefits for cardholders. Therefore, make sure you do your best to make the most of it:

- Insurance Benefits: There is no need to obtain separate travel insurance because this card already provides that coverage. One of the best credit cards for rental car insurance is the Chase Sapphire Reserve.

- Use your card to pay for your flights and travel tickets: If you pay for your tickets with your card, you can get lost luggage and delay reimbursement. You can also get statement credit for travel purchases, which can provide travel reassurance while also adding up to decent rewards.

- Understand all of the card's features – as a luxury card, the Reserve card provides some unique and premium benefits that are not available on other cards. Make sure you are aware of them and can use them at the appropriate time based on your requirements.

How To Apply For Sapphire Reserve Card?

Step 1: Visit the Chase Sapphire Reserve home page, and click on “Apply as a guest”.

Step 2: This takes you to a page where you can fill in your personal details.

Step 3: You hen choose your statement and communication delivery preference, whether you want it by mail or online.

Step 4: Next, take your time to read through the E-sign disclosure and the pricing & terms. Lastly read the certifications, tick the box, and then click “Submit.”

How It Compared To Other Luxury Travel Cards?

The Chase Sapphire Reserve competes with other luxury travel credit cards in a competitive market.

Its most popular competitor is The Platinum Card from American Express, renowned for its extensive travel benefits, including access to a vast network of airport lounges, elite status with hotel programs, and annual airline fee credits.

The Platinum Card caters to frequent travelers who value exclusive airport experiences and luxury hotel stays. Its high annual fee of $695 is justified by the comprehensive suite of perks, making it ideal for those seeking top-tier travel benefits.

The Capital One Venture X Rewards Credit Card comes with a focus on simplicity and flexibility. Boasting a competitive rewards structure and travel statement credits, this card targets a broad audience of travelers who appreciate earning straightforward and versatile rewards without navigating complex redemption options.

With a lower annual fee of $395, the Venture X appeals to those seeking valuable benefits and rewards without the premium cost of some competitors.

The U.S. Bank Altitude Reserve card and the Bank of America Premium Rewards Elite are another worth mentioning premium travel cards. Their annual fee is lower compared to the Reserve card, and hiwle they offer premium perks such as lounge access and annual credit – the benefits are less enticing compared to the other luxury travel cards.

How It Compared To Other Mid-Tier Travel Cards?

The Chase Sapphire Preferred® Card stands out among mid-tier travel cards with its compelling combination of rewards and benefits. When compared to other cards in this category, its versatility and generous welcome bonus make it a strong contender.

In the mid-tier segment, the Chase Sapphire Preferred® Card competes favorably with cards like the Capital One Venture Rewards Credit Card and the American Express Gold Card. While the Venture card offers straightforward rewards with a flat 2 miles per dollar on all purchases, the Sapphire Preferred excels in providing bonus categories, earning 5 points per dollar on travel through Chase Ultimate Rewards® and 3 points on dining, among others.

The American Express Gold Card, on the other hand, focuses on dining and groceries, offering 4 points per dollar at restaurants and U.S. supermarkets. The Amex Gold also offers better travel perks,such as TSA PreCheck rreimbursementHowever, the Chase Sapphire Preferred® Card's broader range of travel bonus categoriese caters to a more travel-focused set of spending patterns than everyday spending.

One notable competitor is the Citi Premier® Card, which emphasizes travel and dining rewards. While it offers 3 points per dollar on these categories, the Chase Sapphire Preferred® Card's 5 points per dollar on travel through Chase Ultimate Rewards® and the option to transfer points to various partners provide additional flexibility.

Other than that, there are many co-branded cards for a specific airline or hotel network. When it comes to airlne, the Delta SkyMiles Gold American Express Card, the United Explorer and the American Airlines Platinum Select card offers priority boarding, free checked bagd and other airline – focused rewards. The same with basic hotel cards scuh as the Marriot Bonvoy Boundless or the Hilton Honors American Express card.

Is the Chase Sapphire Reserve Card Right for You?

Chase Sapphire Reserve is one of the best travel reward cards for those with excellent credit.

If you spend much of your time traveling and eating out, this is an excellent card offering the best travel rewards in the market. Chase Sapphire Reserve offers a very large sign-up bonus and many travel perks.

The large annual fee may scare off some consumers and this may not be the right travel reward card for those who travel only a couple of times a year. This card is for consumers who do a lot of traveling and that want to maximize rewards.

The Chase Sapphire Reserve Card is a good option if you have:

- Travel Frequently: If you travel frequently, you may be able to justify the high annual fee. This is due to the fact that you are eligible for some spectacular rewards.

- If you like to travel in style: cardholders have access to over 1,000 VIP airport lounges around the world. You also get free credits for things like TSA Precheck and Global Entry every year.

- Want Generous Rewards: By using this card for certain types of purchases, you can earn significant rewards. These benefits can quickly add up.

Compare The Alternatives

There a couple of travel premium cards that can be considered as an alternative to the Chase Reserve card. You may want to explore them before applying:

|

|

| |

|---|---|---|---|

The Platinum Card® from American Express | Chase Sapphire Reserve® | Capital One Venture X Rewards | |

Annual Fee | $695. See Rates & Fees | $550 | $395 |

Rewards |

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. | 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

|

Welcome bonus |

80,000 points

80,000 Membership Rewards® points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership

|

60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| 75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

|

Foreign Transaction Fee | $0. See Rates & Fees | $0 | $0

|

Purchase APR | 21.24% – 29.24% APR Variable | 22.49%–29.49% variable | 19.99% – 29.99% (Variable) |

FAQ

Yes, you can get car rental insurance with this card if you decline the collision cover of the rental company and pay for the entire cost of the rental car with this card. Please review the terms and conditions before to make sure you're covered.

There are no transparent income requirements, but it is usually expected that your annual income is at least $60,000 and you may be asked for proof of income.

There is no sort of limit in place how much cash back or rewards that you can earn when you are using this card over time.

You can redeem your points in a variety of ways through the Chase credit card reward portal. Some of the perks you can get include cash, travel credit, statement credit, and gift cards.

Compare Chase Sapphire Reserve Card

When it comes to the annual fee, there is a clear winner. But is it worth the exclusive travel rewards you'll get? Here's our analysis.

While Chase Sapphire Reserve offers better protections and redemption options, Venture X is cheaper and offers premium travel benefits.

Chase Sapphire Reserve vs. Capital One Venture X: Comparison

If you're looking for travel rewards, there is a clear winner. But what about if you're looking for rewards on everyday spending?

American Express Gold Card vs Chase Sapphire Reserve: Which Card Is Best?

When it comes to premium travel rewards, both may be the best cards in the market. But who is the winner between the two? Here's our analysis.

American Express Platinum vs Chase Sapphire Reserve: Which Is Better?

The Chase Sapphire Reserve offers more versatile travel rewards and redemption options. But if you need airline perks, the Delta Reserve wins.

Chase Sapphire Reserve vs. Delta SkyMiles Reserve: Comparison

While the Brilliant card focuses on benefits tailored to Marriott enthusiasts, the Chase Reserve focuses on general, luxury travel perks.

Marriott Bonvoy Brilliant vs. Chase Sapphire Reserve: How They Compare?

While both cards offer premium travel perks, the Chase Reserve is the winner as it provides better travel perks and more redemption options.

Bank of America Premium Rewards Elite vs. Chase Sapphire Reserve: Which Card Is Best?

The Chase Reserve wins on cashback rates, travel perks, and insurance. Is it worth the annual fee difference? We think it does – here's why.

Chase Sapphire Reserve vs. Delta SkyMiles Platinum: Side By Side Comparison

The Hilton Amex Aspire offers excellent value for hotel perks, while the Chase Reserve card is best for flexibility and redemption options.

Chase Sapphire Reserve vs. Hilton Amex Aspire: Side By Side Comparison

While having higher annual fee, the Chase Sapphire Reserve is a clear winner with much higher total cashback and better premium travel perks.

Both Citi/AAdvantage Executive and Chase Sapphire Reserve offer great cashback value, but the latter is our winner. Here's why:

Citi/AAdvantage Executive World Elite vs. Chase Sapphire Reserve: Which Card Is Best?

The Chase Sapphire Reserve card stands out as the superior choice, delivering greater annual cashback value and luxurious travel benefits.

Chase Sapphire Reserve vs. Emirates Skywards Premium World Elite Mastercard: Which Card Is Best?

Despite being a pricier card, the Chase Sapphire Reserve is our top choice because of its generous cashback system and luxury travel perks.

U.S. Bank Altitude Reserve Visa Infinite vs. Chase Sapphire Reserve: How They Compare?