Choosing the right credit card is crucial to meet your needs. Cashback cards reward you with money for making purchases and timely bill payments. However, finding the perfect card that aligns with your budget and preferences is essential.

Researching various cashback cards is worthwhile, as they offer rewards for diverse categories like travel, groceries, online shopping, car maintenance, and more. With numerous options available, understanding complex terms and conditions can be confusing.

To assist, we've compared and listed The Smart Investor Select’s top picks for the best cash-back credit cards.

Card | Rewards | Bonus | Annual Fee | Best For |

| 1-5%

5% at Amazon.com, Amazon Fresh , Whole Foods Market and on Chase Travel purchases, 2% cash back on gas stations, restaurants and on local transit and commuting, 1% cash back on all other purchases

| $100

$100

| $0 ($139 Amazon Prime subscription required) | Online Shopping |

|---|---|---|---|---|---|

| 1-5%

5% cash back on up to $1,500 in combined purchases on selected categories each quarter and 5% cash back on travel purchased through Chase Ultimate Rewards®. Also, you can earn 3% cash back on dining at restaurants (including takeout and eligible delivery services), drugstore purchases , and 1% on all other purchases

| $200

$200 bonus after you spend $500 on purchases in the first 3 months from account opening

| $0 | Rotating Categories | |

| 1.5% – 5%

5% percent cash back on hotels and rental cars booked through Capital One Travel and 1.5% cash back on all purchases everyday.

| $200

$200 cash bonus once you spend $500 on purchases within 3 months from account opening

| $0 | Less than Perfect Credit | |

| 1% – 4%

unlimited 4% cash back on dining, entertainment, and popular streaming services, 3% at grocery stores and 1% on all other purchases.

| $300

$300 cash bonus once you spend $3,000 on purchases within 3 months from account opening

| $95 | Sign up Bonus | |

| 1-6%

6% cash back at U.S. supermarkets (up to $6,000 per year in purchases, then 1%) and selected U.S. streaming subscriptions, 3% cash back on transit

and U.S. gas stations, 1% cash back on other purchases

| $250

$250 statement credit after you spend $3,000 in purchases on your new Card within the first 6 months

| $95 ($0 intro for the first year), Rates & Fees | High Cash Back | |

| 1-4%

4% cash back on on eligible gas and EV charging purchases for the first $7,000 per year and then 1% thereafter, 3% cash back on restaurants and most travel purchases, 2% cash back at Costco and Costco.com, 1% cash back on all other purchases

| None

| $0 ($60 Costco membership fee required) | Store Cash Back | |

| 1% – 5%

2% cash back rewards rate – 1% every time you swipe and another 1% upon payment.

| $200

$200 cash back after you spend $1,500 on purchases in the first 6 months of account opening

| $0 | Flat Rate Cashback | |

| 1.5% – 2.5%

up to 2.5% cash back on your first $10,000 of qualifying eligible purchases (1.5% for purchases over $10,000)

| None

None

| $99

| Credit Unions | |

| 1-5%

5% cashback on up to $1,500 in rotating category purchases each quarter when you activate the bonus category (then 1%), as well 1% percent cash back on all other purchases

| Cashback Match

All cash back earned at the end of the first 12 months is matched.

| $0 | Digital Experience |

Amazon Prime Rewards Visa Signature Card

Reward Details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Amazon Prime Rewards Visa Signature Card is one of the best shopping cards available, especially if you're a frequent buyer on Amazon. This card offers an outstanding 5% at Amazon.com, Amazon Fresh , Whole Foods Market and on Chase Travel purchases, 2% cash back on gas stations, restaurants and on local transit and commuting, 1% cash back on all other purchases, making it a suitable choice for commuters and a $0 fee on foreign transactions.

However, warehouse clubs and superstores are not included and you aren't eligible for 0% intro APR period. Overall, the Amazon card is suitable for individuals that buy or purchase their groceries at traditional supermarkets.

- Rewards Plan: 5% at Amazon.com, Amazon Fresh , Whole Foods Market and on Chase Travel purchases, 2% cash back on gas stations, restaurants and on local transit and commuting, 1% cash back on all other purchases

- APR: 19.49% – 27.49% Variable

- Annual Fee: $0 ($139 Amazon Prime subscription required)

- Balance Transfer Fee: $5 or 5%, whichever is greater

- Foreign Transaction Fee: $0

- Sign Up bonus: $100 Amazon gift card upon approval

- Sign-Up Bonus

- Cash Back at Supermarkets & Gas Stations

- No Annual Fee

- Extended Warranty on Purchases

- Amazon Prime subscription required

- Balance Transfer Fee

- Foreign Transaction Fee

- Minimum Redemption Amounts

Does the card have a rewards limit?

The Amazon card doesn't have a rewards limit, so you can earn cash back on all of your purchases. It has a tiered structure, so even purchases that are not on Amazon can still earn you some cash back.

Does anyone can get the Amazon card?

you’ll need good to excellent credit for the Amazon Prime Rewards card. Although your income will be one of the factors assessed during your application, your credit score will be a more important consideration.

Can you get pre approved

There is no pre approval option for the Amazon Prime Rewards card. This means that you’ll need to complete a full application and this will trigger a hard pull on your credit.

What’s the initial credit limit I'll get?

The Amazon Prime Rewards card has a minimum initial credit limit of $500. The exact amount can be much higher but it mainly depends on your credit score.

How long does approval take?

If you don’t get an instant decision after you submit the online application form for the Amazon Prime Rewards card, you may be waiting two to four weeks.

What are the top reason not to get the Amazon card?

The top reason not to get the Amazon Prime Rewards card is that you don’t tend to spend a lot with Amazon or Whole Foods.

Sam's Club Mastercard

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

The Sam’s Club Mastercard is a great card for Sam’s Club shoppers. It has very competitive cashback rewards and benefits in some spending categories.

Sam’s Club Mastercard offers 5% cash back on gas anywhere Mastercard is accepted (on the first $6,000 per year, then 1% after), 3% cash back on Sam’s Club purchases for Plus members, 3% on dining and takeout and 1% on all other purchases. The rewards categories do not change and are great for those who spend a lot on gas and traveling and who are Sam’s Club members.

The card does not have a foreign transaction fee or annual fee as long as you are a Sam’s Club member (Membership starts at $45 a year). This card can be used anywhere Mastercard is accepted, not just at Sam’s Club.

- APR: 20.40% or 28.40% Variable

- Annual fee: $0 ($50/$110 for Club/Plus membership – MUST)

- Balance Transfer Fee: N/A

- Foreign Transaction Fee: N/A

- Rewards Plan: 5% cash back on gas anywhere Mastercard is accepted (on the first $6,000 per year, then 1% after), 3% cash back on Sam’s Club purchases for Plus members, 3% on dining and takeout and 1% on all other purchases

- Sign Up bonus: $30 statement credit after making $30 in Sam’s Club purchases within the first 30 days

- 0% APR Introductory Rate period: N/A

- Cash Back on Gas, Restaurants and Travel & Other Spending

- No Annual Fee

- Higher cashback on Sam's Club purchases

- Redemption Restrictions

- No Sign-Up Bonus or 0% APR Introductory Rate

- Rewards Cap

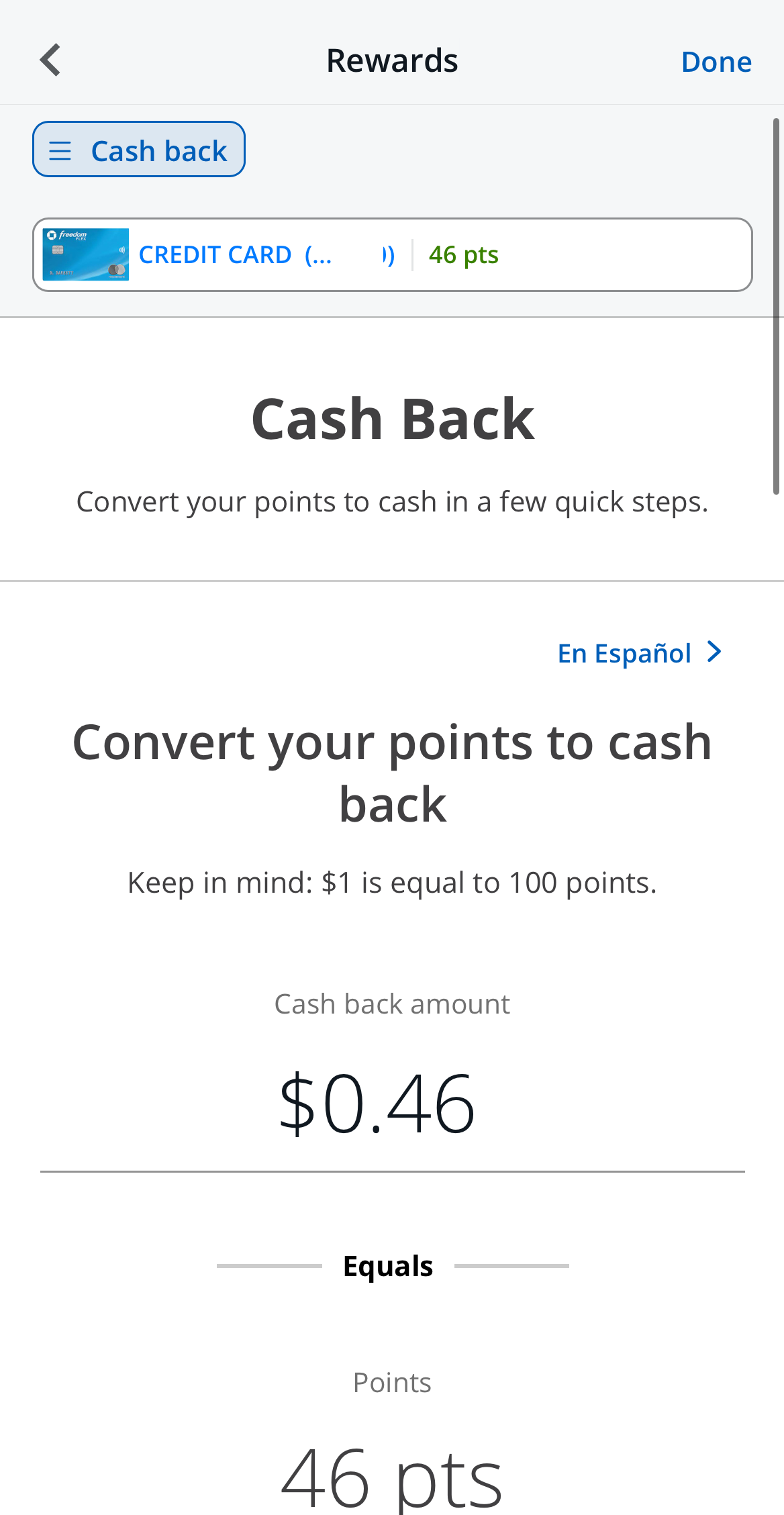

Chase Freedom Flex℠ Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

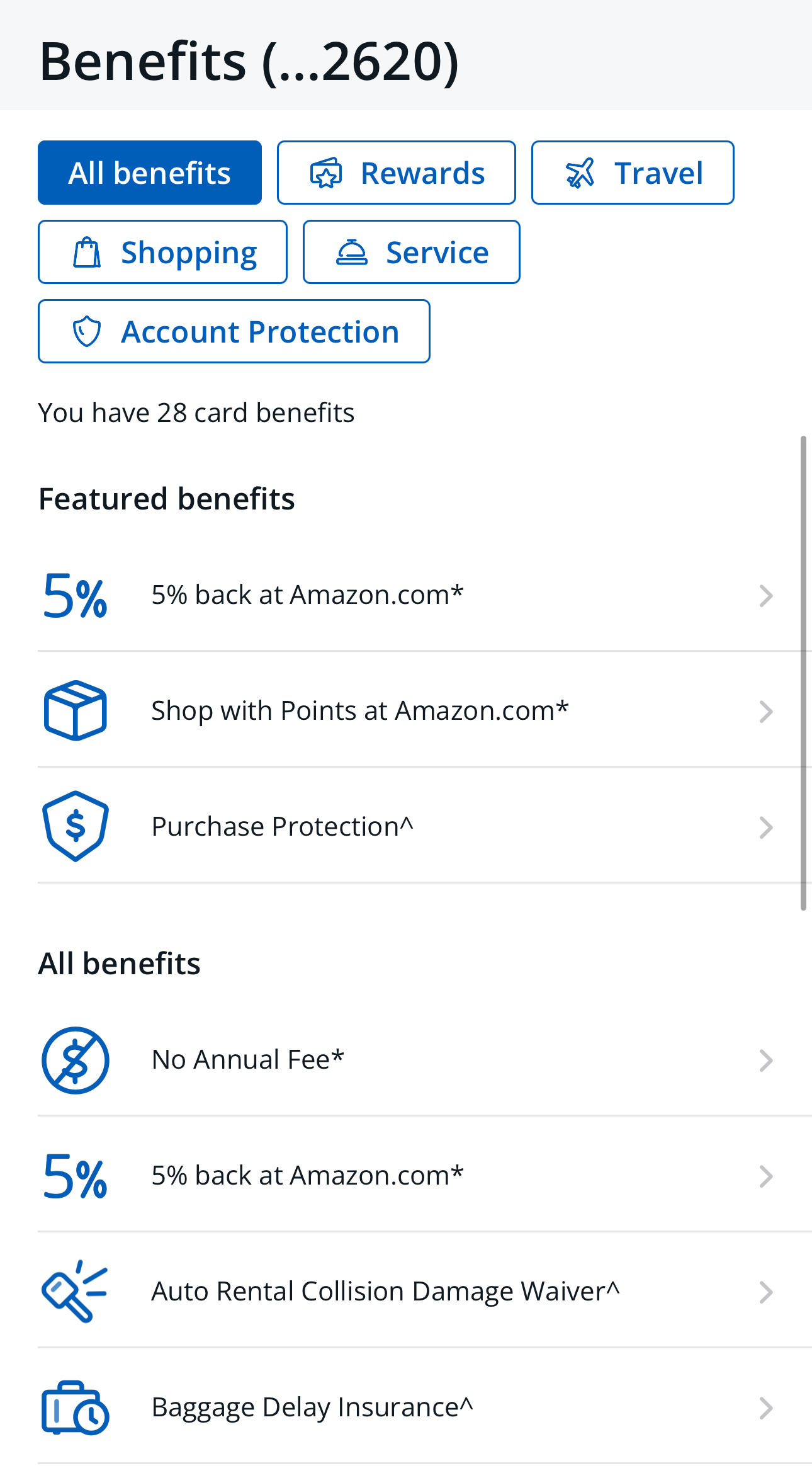

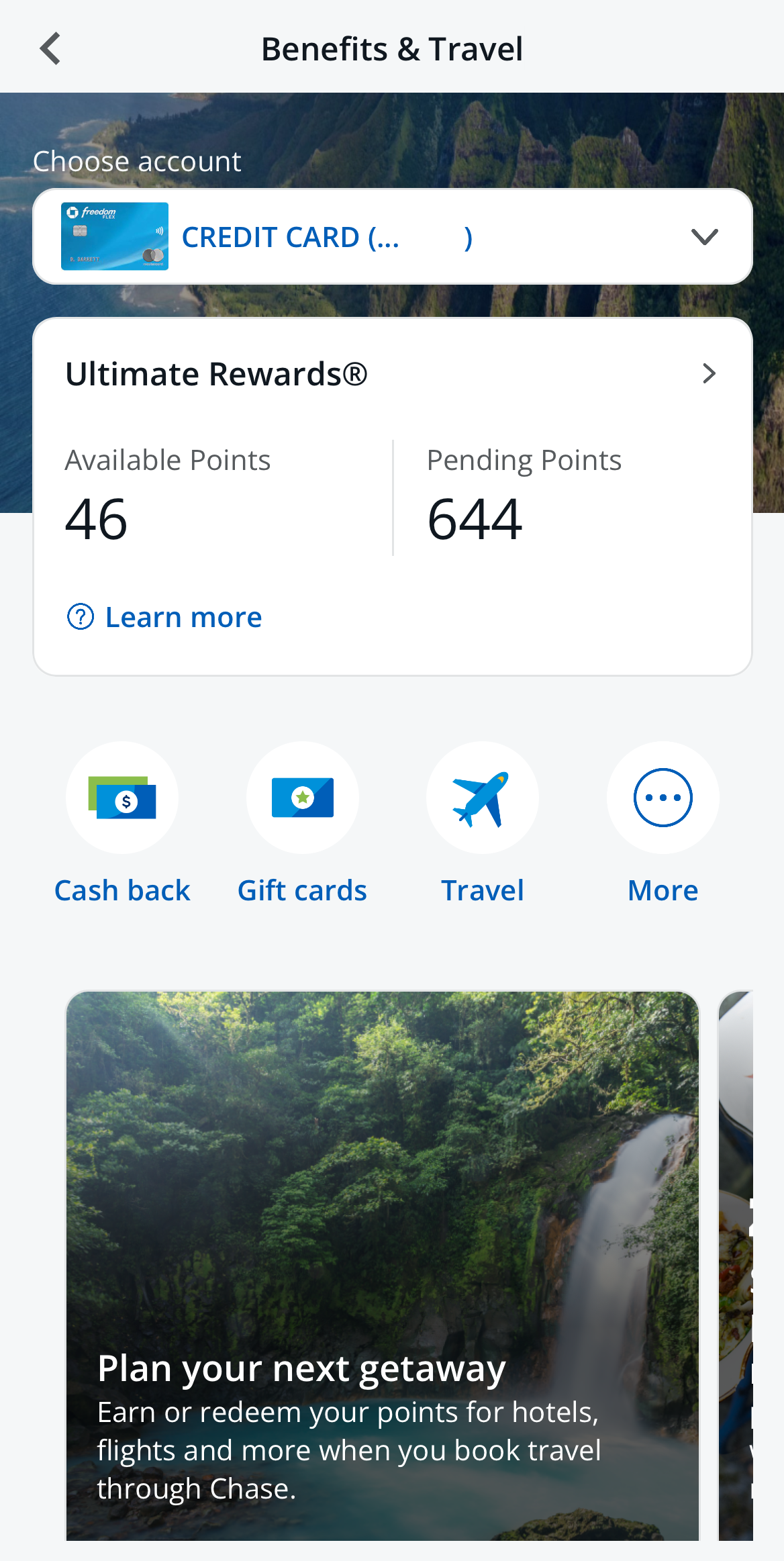

If you have a high credit score and want a card to capture your spending habits with no extra cost. The Chase Freedom Flex℠ Card has a $0 annual fee, and you can earn 5% cash back on up to $1,500 in combined purchases on selected categories each quarter and 5% cash back on travel purchased through Chase Ultimate Rewards®. Also, you can earn 3% cash back on dining at restaurants (including takeout and eligible delivery services), drugstore purchases , and 1% on all other purchases.

The sign up bonus includes $200 bonus after you spend $500 on purchases in the first 3 months from account opening. Overall, this is a great card for everyday spending. If you're looking for a travel card, you may want to check the Chase Sapphire Preferred or Reserve cards.

- Rewards Plan: 5% cash back on up to $1,500 in combined purchases on selected categories each quarter and 5% cash back on travel purchased through Chase Ultimate Rewards®. Also, you can earn 3% cash back on dining at restaurants (including takeout and eligible delivery services), drugstore purchases , and 1% on all other purchases

- APR: 20.49%–29.24% variable

- Annual fee: $0

- Balance Transfer Fee: $5 or 5% (the greater)

- Foreign Transaction Fee: 3%

- Sign Up bonus: $200 bonus after you spend $500 on purchases in the first 3 months from account opening

- 0% APR Introductory Rate period: 15 months on purchases and balance transfers

- Sign Up Bonus

- No Annual Fee

- 0% Intro APR

- Protection & Free Credit Score

- Higher cashback Bonuses has a Cap

- Balance Transfer Fee

- Foreign Transaction Fee

- Is there a limit to cashback? There is a cap on the bonus categories whereby it will cover up to $1,500 of relevant purchases per quarter.

- Can I get car rental insurance with a Chase Freedom Flex card? Yes, when you rent the car and pay for all of it with this card and do not accept coverage from the rental company.

- What are Chase Freedom Flex card income requirements? No specific income requirements and it does not usually ask for proof of income requirements.

- Does card Chase Freedom Flex offer pre approval? Yes, you can get pre-approval.

- What is the initial credit limit of the Freedom Flex? The initial credit limit varies, but can often be between $300 and $1,000. The average limit for this card is $3,000.

- How do I redeem cashback? You go to the Ultimate Rewards section that Chase offers and you can choose between the options as to how you utilize the rewards.

- What purchases don't earn cashback? All purchases earn cashback with this card.

- Should You Move to Chase Freedom Flex card? This is a good fit for people who are looking for good cashback rates, as well as getting access to quarterly bonus categories for enhanced rates.

- How hard is it to get it? It is not very hard to get this type of card once you meet all of the straightforward requirements.

- How to maximize rewards on Chase Freedom Flex card? You go to the Ultimate Rewards section that Chase offers and you can choose between the options as to how you utilize the rewards. To maximize rewards, you should make sure that you take advantage of the bonus categories and leave the other types of purchases that are not covered by an enhanced rate to another card. This is because you will only get 1% cashback on non-covered purchases.

- Top Reasons NOT to get the Chase Freedom Flex card? If you make a lot of purchases not covered by the respective categories and will only get 1% cashback on them. You may also travel a lot and not want to pay the 3% foreign exchange transaction charge that comes with this card.

Capital One Quicksilver Cash Rewards Credit Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Capital One Quicksilver card is a good choice for individuals that either don’t like to spend too much in just one budget category or individuals that prefer one reward rate than multiple rates. The Capital One Quicksilver offers 5% percent cash back on hotels and rental cars booked through Capital One Travel and 1.5% cash back on all purchases everyday.. This cashback rate is not the highest in the market, but card do not charge any annual fee, and it has a nice welcome bonus of $200 cash bonus once you spend $500 on purchases within 3 months from account opening.

Lastly, the card offers a generous 0% intro APR. Some of the benefits individuals can derive from using this card include; no foreign transaction fees, travel accident insurance, secondary car rental insurance and 24-hour travel assistance services.

- Rewards Plan: 5% percent cash back on hotels and rental cars booked through Capital One Travel and 1.5% cash back on all purchases everyday.

- APR: 19.99% – 29.99% variable

- Annual fee: $0

- Balance Transfer Fee: 3%

- Foreign Transaction Fee: $0

- Sign Up bonus: $200 cash bonus once you spend $500 on purchases within 3 months from account opening

- 0% APR Introductory Rate period: 15 months on balance transfers and purchases

- Sign-Up Bonus

- Flat Cashback Rewards Rate

- No Annual Fee or Foreign Transaction fee

- Intro APR on Purchases & Balance Transfers

- No Bonus Rewards Categories

- Cashback Rate Could Be Better

- Requires Good/Excellent Credit

- Can I get car rental insurance with Quicksilver Card? Yes, once you refuse the insurance offered by the rental company you will automatically get coverage if you fund the entire purchase through this card.

- What are Quicksilver Card income requirements? Capital One often required monthly income to be at least $800. Sometimes, you will need to show some proof of income.

- Can I get pre-approved? Yes, you can get pre-approval.

- What is the initial credit limit? You will normally get a credit limit of at least $5,000.

- How do I redeem cash back? For the Quicksilver cashback rewards, you are able to get a check, as statement credit, or redeem them with certain retailers.

- What purchases don't earn cash back? All purchases are covered.

- Should You Move to Quicksilver Card? If you want consistency across all types of purchases or need to fill some gaps thrown up by other cards.

- How to Use Quicksilver card Benefits? Use it to fill the gap where your other credit cards fall short. If you want to have ultimate ease of use thanks to the consistency across all types of purchases.

- What are the top Reasons NOT to get the Quicksilver Card? If you are looking to get higher cashback rewards for certain categories.

Capital One Savor Cash Rewards Credit Card

Reward Details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Capital One Savor credit card offers unlimited 4% cash back on dining, entertainment, and popular streaming services, 3% at grocery stores and 1% on all other purchases.. Rewards don’t expire for the life of the account, and you can redeem cash back for any amount.

In addition, there is a significant sign up bonus of $300 cash bonus once you spend $3,000 on purchases within 3 months from account opening, as well as no foreign transaction fee.

However, if you don’t spend enough on these types of activities then you won’t get ahead much on the rewards due to the $95 annual fee.

- Rewards Plan: unlimited 4% cash back on dining, entertainment, and popular streaming services, 3% at grocery stores and 1% on all other purchases.

- APR: 19.99% – 29.99% Variable

- Annual fee: $95

- Balance Transfer Fee: 3%

- Foreign Transaction Fee: $0

- Sign Up bonus: $300 cash bonus once you spend $3,000 on purchases within 3 months from account opening

- 0% APR Introductory Rate period: None

- Sign Up Bonus

- High Cash Back

- No Rotating Categories

- $95 Annual Fee

- Approval Can Be Strict

- No 0% Intro APR

- Can I get car rental insurance with Capital One Savor? Yes, once you refuse the insurance offered by the rental company you will automatically get coverage if you fund the entire purchase through this card.

- Does it have a cash-back rewards limit? There is no limit.

- Does Capital One ask for proof of income? No out and out request for proof of income and no transparent income requirements.

- Does Capital One Savor Card offer pre approval? Yes, you can get pre-approval.

- What is the initial credit limit? The minimum credit limit is set at $5,000.

- How do I redeem cash back? You can get them sent to you in the form of a check, as a statement credit, or get them given to you through gift cards.

- What purchases don't earn cash back? All types of purchases are eligible for cashback with this card.

- Should You Move to Capital One Savor Card? If you spend enough on the premium cashback categories to justify the annual fee.

- Why did Capital One Savor Card deny me? What to Do Next? You might not have met all of the requirements. You can enquire as to where your application fell short. If you cannot proceed, you can look at some of the other available options.

- How to maximize rewards on Capital One Savor Card? Make the most out of the signup offer and use this card for the premium cashback categories to get the best bang for your buck.

- Top reasons NOT to get the Capital One Savor Card? If you will not reap enough rewards to justify the $95 annual fee.

Blue Cash Preferred® Card from American Express

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

Rates & Fees, Terms Apply

- Overview

- Features

- Pros & Cons

- FAQ

The Blue Cash Preferred® Card from American Express offers an outstanding 6% cash back at U.S. supermarkets (up to $6,000 per year in purchases, then 1%) and selected U.S. streaming subscriptions, 3% cash back on transit and U.S. gas stations, 1% cash back on other purchases , making it a suitable choice for commuters and a 2.70% fee on foreign transactions. Terms Apply.

However, warehouse clubs and superstores are not included. The American Blue Cash Preferred Card charges an annual fee of $95 ($0 intro for the first year), but you can justify this if you reach the higher cashback threshold in U.S. supermarkets. This makes the card suitable for individuals that buy or purchase their groceries at traditional supermarkets. New cardmembers can earn up to $250 statement credit after you spend $3,000 in purchases on your new Card within the first 6 months.

- Rewards Plan: 6% cash back at U.S. supermarkets (up to $6,000 per year in purchases, then 1%) and selected U.S. streaming subscriptions, 3% cash back on transit and U.S. gas stations, 1% cash back on other purchases

- APR: 19.24% – 29.99% Variable

- Annual Fee: $95 ($0 intro for the first year)

- Balance Transfer Fee: $5 or 3%, whichever is greater

- Foreign Transaction Fee: 2.70%

- Welcome Bonus: $250 statement credit after you spend $3,000 in purchases on your new Card within the first 6 months

- 0% APR Introductory Rate Months: 12 months on purchases and balance transfers

* Terms Apply

- Welcome Bonus

- Cash Back Rewards

- 0% APR Intro

- Redeeming Options

- Extended Warranty on Purchases

- $95 Annual Fee

- Short Introductory Rates

- Balance Transfer Fee

- Foreign Transaction Fee

- Minimum Redemption Amounts

- Is there a limit to rewards/cash back? You can get the premium cashback rate on groceries until you have annual purchases in this area of $6,000. The rate then goes to 1%.

- Can I get car rental insurance? how? Yes, you will get this insurance if you refuse the car rental company’s insurance coverage and you pay for the entire cost of the rental with this card.

- Does it have a cash-back/point rewards limit? You can get the premium cashback rate on groceries until you have annual purchases in this area of $6,000. The rate then goes to 1%. Otherwise, there are no restrictions.

- Do you need a proof of income? No transparent income requirements or proof of income requests.

- Does the rewards points expire? They do not expire once you keep your account open and meet a few basic conditions.

- Can I get pre-approved? Yes, you can get pre-approval.

- What is the initial credit limit? It will be at least $1,000 and usually greater.

- How do I redeem cash back? The rewards will be credited to you in the form of a statement credit.

Costco Anywhere Visa® Card by Citi

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Card Features

- Pros & Cons

- FAQ

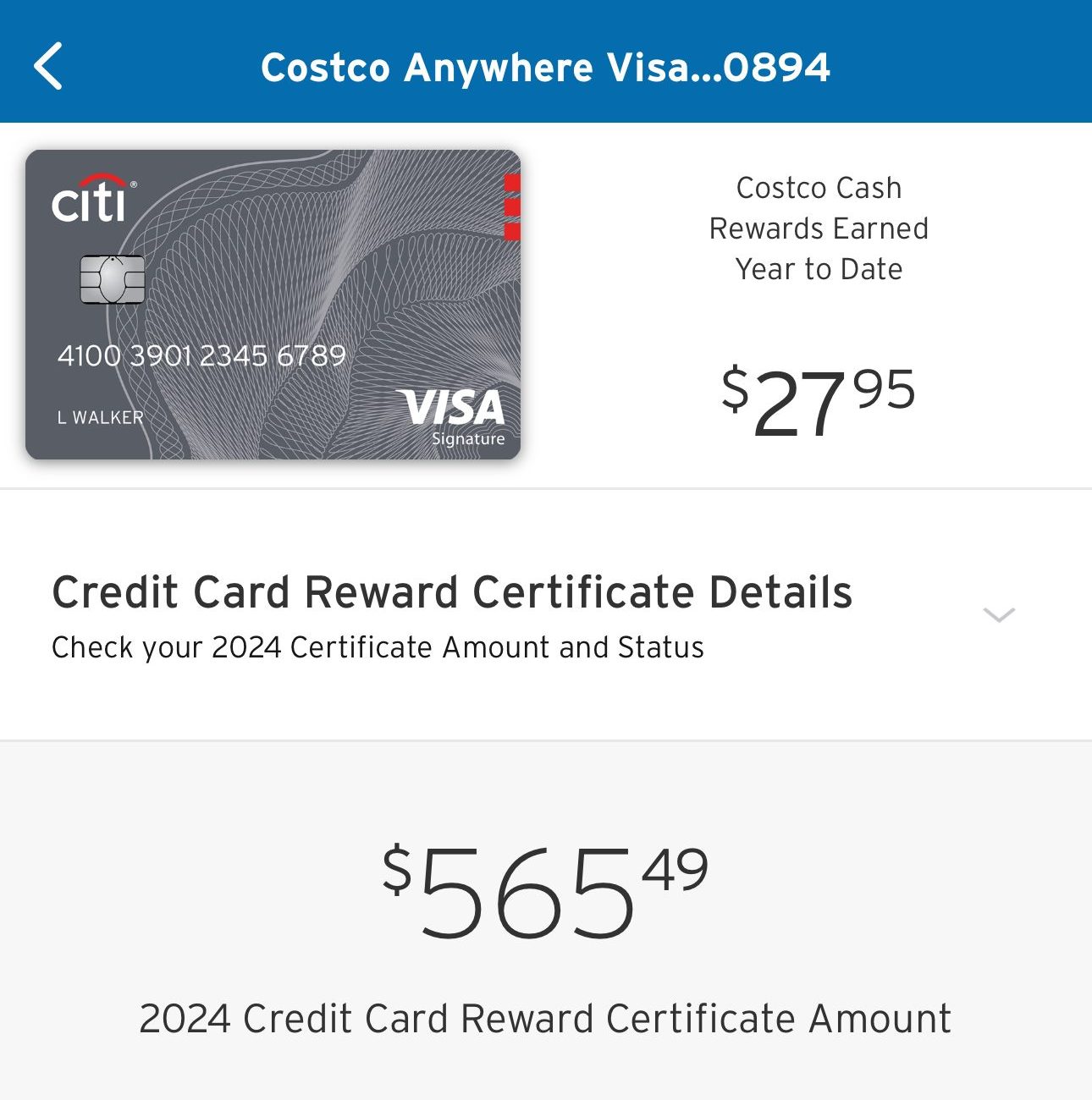

The Costco Anywhere Visa® Card by Citi is an amazing choice for regular Costco shoppers who want to earn a highly competitive cashback rewards, and one of the best shopping cards available. Costco card does not charge any fee on foreign transactions and does not charge any annual fee. The card offers 4% cash back on on eligible gas and EV charging purchases for the first $7,000 per year and then 1% thereafter, 3% cash back on restaurants and most travel purchases, 2% cash back at Costco and Costco.com, 1% cash back on all other purchases.

To enjoy all these benefits, all you need to do is pay your annual Costco membership fee to maintain your card account. Some of the limitations attached to this card usage include; limited cashback redemption option and a cap on gas rewards.

- Rewards Plan: 4% cash back on on eligible gas and EV charging purchases for the first $7,000 per year and then 1% thereafter, 3% cash back on restaurants and most travel purchases, 2% cash back at Costco and Costco.com, 1% cash back on all other purchases

- APR: 20.49% (Variable)

- Annual fee: $0 ($60 Costco membership fee required)

- Balance Transfer Fee: 3% or 5$

- Foreign Transaction Fee: $0

- Sign Up bonus: None

- 0% APR Introductory Rate period: N/A

- Cashback on Costco, Gas, Restaurants and Travel and Other Spending

- No Annual Fee

- No Foreign Transaction Fee

- Extended Manufacturer Warranty, Travel Perks

- Redemption Restrictions

- No Sign-Up Bonus or 0% APR Introductory Rate

- There are Better Cashback Cards

- High APR

What’s the initial credit limit?

The initial credit limit for the Costco Anywhere visa is $500, but some cardholders have been offered an initial limit as high as $10,000.

What are the top reasons not to get the Costco card?

The top reason to not get the Costco Anywhere card is if you can get better rewards on a different tier card. There are some cards out there that offer 5% on one or two categories, which provides greater flexibility.

How’s the card customer service availability?

Citi has phone lines that are open 24/7, so you can access support at any time.

How much should I spend to cover the card fees?

There is no annual fee, However, you do need to have a Costco membership for the Costco Anywhere, but presumably, you’ll already have this covered.

Is it hard to get the Costco card?

To qualify for the Costco Anywhere card, you must have excellent credit and a low income-to-debt ratio.

Can I get pre approved?

Citi does not support Costco Anywhere card pre-approval. You'll need to fill out a full application, which will include a hard credit pull.

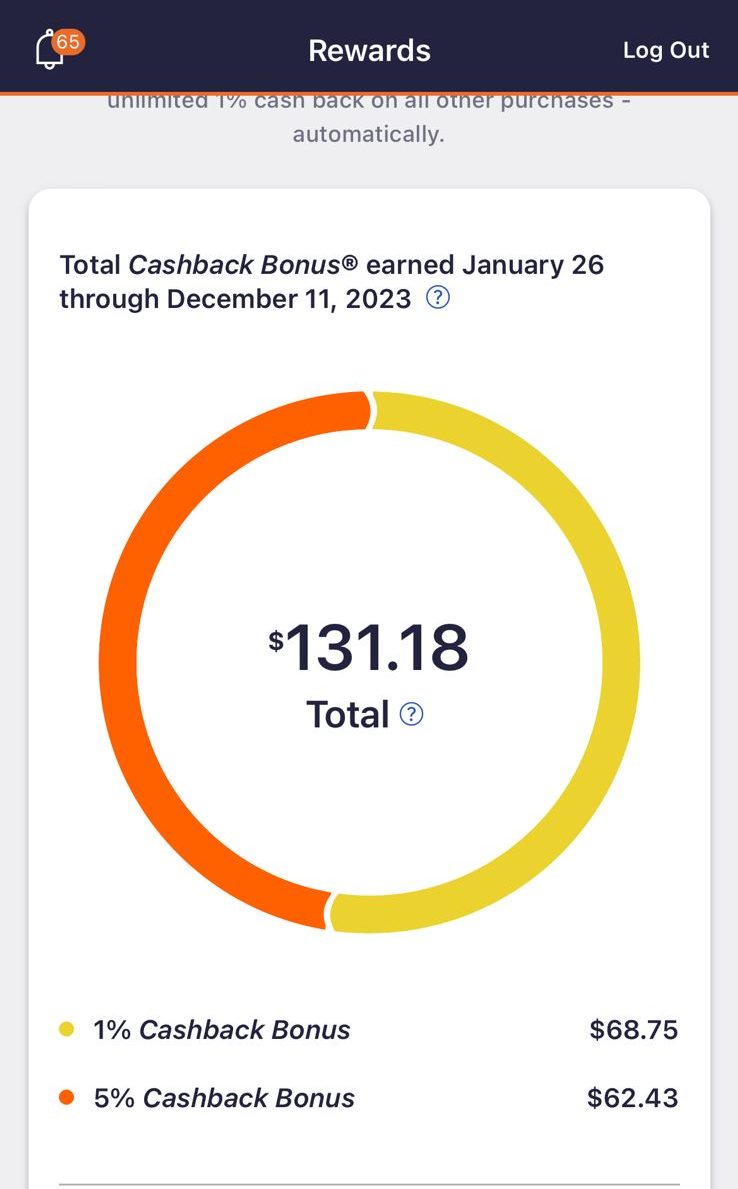

U.S. Bank Shopper Cash Rewards

U.S. Bank Shopper Cash Rewards Review

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The U.S. Bank Shopper Cash Rewards Visa Signature Card offers an enticing rewards program for cardholders – 6% cash back on your first $1,500 in combined eligible purchases each quarter at two retailers you choose, 3% back on your first $1,500 in eligible purchases each quarter on your choice of one everyday category, 1.5% back on all other qualifying purchases. Also, 5.5% back on reservations for hotels and prepaid car rentals when you book through the U.S. Bank Rewards Center.

Also, this card provides a $250 bonus after you spend $2,000 in eligible purchases within the first 120 days of account opening. The first year comes with no annual fee.

The application process is swift, with decisions made in as little as 60 seconds. Flexible redemption options allow for cash back as a statement credit, rewards card, merchant gift cards, or direct deposits into U.S. Bank accounts.

- Rewards Plan: 6% cash back on your first $1,500 in combined eligible purchases each quarter at two retailers you choose, 3% back on your first $1,500 in eligible purchases each quarter on your choice of one everyday category, 1.5% back on all other qualifying purchases. Also, 5.5% back on reservations for hotels and prepaid car rentals when you book through the U.S. Bank Rewards Center.

- APR: 19.74% – 29.74%

- Annual fee: $95 ($0 on first year)

- Balance Transfer Fee: 3%, $5 minimum

- Foreign Transaction Fee: 3%

- Sign Up bonus: $250 bonus after you spend $2,000 in eligible purchases within the first 120 days of account opening

- 0% APR Introductory Rate period: 15 billing cycles if you transfer a balance in the first 60 days of opening your account

- High rewards rate

- High Welcome Bonus

- Bonus categories

- Annual fee

- Must enroll each quarter

- Foreign transaction fee

What are the eligible 6% bonus categories for this card?

The card offers 6% cash back at retailers like Apple, Amazon.com, Best Buy, Home Depot, Target, and more. The list is subject to change

How quickly can I get a decision on my card application?

You can receive a decision in as little as 60 seconds when applying for the U.S. Bank Shopper Cash Rewards Visa Signature Card.

What are some additional benefits of the U.S. Bank Shopper Cash Rewards Visa Signature Card?

Card benefits include purchase security, extended warranty protection, return protection, ID Navigator identity theft protections, and special guest status at 900+ Visa Signature Luxury Hotel properties worldwide.

Can cash back be redeemed for travel rewards with this card?

The redemption options are primarily cash-based, and travel transfer partners are not available.

Apple Credit Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Card Features

- Pros & Cons

- FAQ

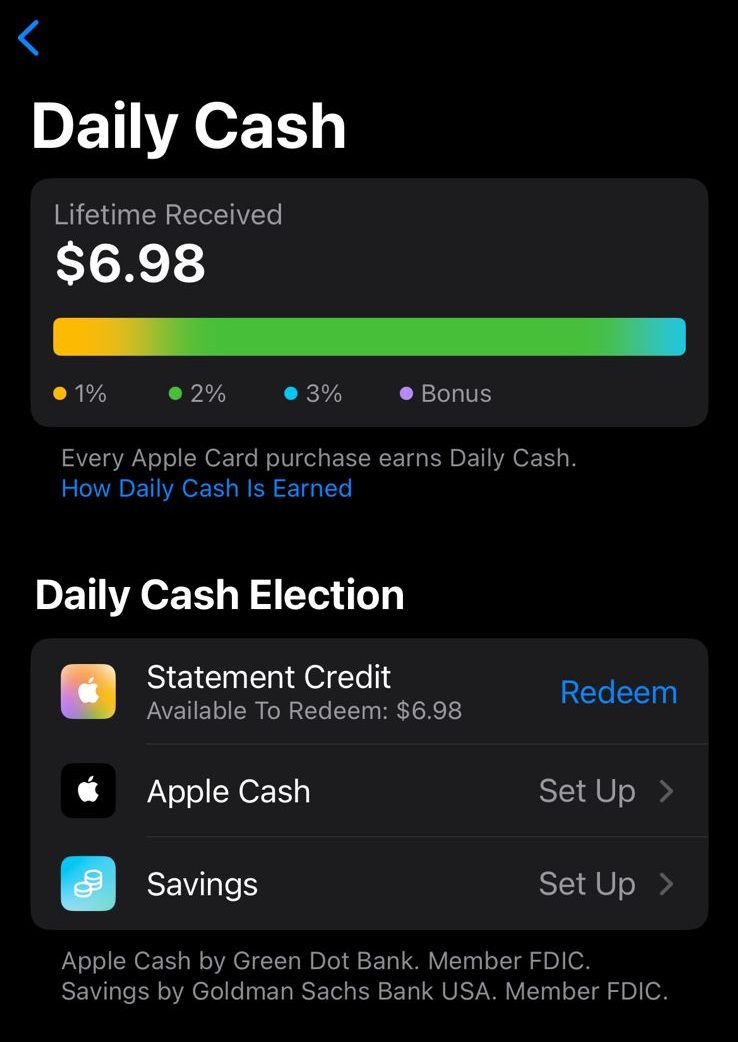

The Apple Card, a collaboration between Apple and Goldman Sachs on the Mastercard network, presents a compelling rewards program, especially for avid Apple Pay users.

This no-annual-fee card offers 3% cash back at Apple and select Apple pay partners. 3% Daily Cash back at Ace Hardware, Duane Reade, Exxon, Mobil, Nike, Panera Bread, T-Mobile, Uber, Uber Eats, and Walgreens. 2% on other Apple pay purchases, and 1% on all other purchases. The card stands out with innovative security features, debt management tools, and a unique numberless titanium physical card.

Despite its strengths, the Apple Card has limitations. It lacks a welcome bonus, and its 1% cash back on non-Apple or non-Apple Pay purchases may be uncompetitive compared to other rewards cards.

The card requires Apple hardware and Apple Pay for optimal benefits, and the physical titanium card must be requested separately. While it offers interest-free financing on select Apple products, it falls short in providing broader rewards compared to competitors.

- Rewards Plan: 3% cash back at Apple and select Apple pay partners. 3% Daily Cash back at Ace Hardware, Duane Reade, Exxon, Mobil, Nike, Panera Bread, T-Mobile, Uber, Uber Eats, and Walgreens. 2% on other Apple pay purchases, and 1% on all other purchases

- APR: 15.99% – 26.99% Variable

- Annual fee: $0

- Balance Transfer Fee: N/A

- Foreign Transaction Fee: $0

- Sign Up bonus: N/A

- 0% APR Introductory Rate period: N/A

- Innovative Security Features

- Daily Cash Access

- Apple Card Family Account Sharing:

- Apple Products Interest-Free Financing

- Apple Savings Account

- Low Cash Back Outside Apple Ecosystem

- Requirement for Apple Hardware

- No Welcome Bonus

- Apple Pay Dependency

How do I apply for the Apple Card?

You can apply through the Wallet app on your iPhone, and if approved, you can use the card immediately.

How can I redeem the cash back earned with the Apple Card?

Cash back, known as “Daily Cash,” can be used for purchases, transferred to friends via Messages, used to pay your card bill, or added to a savings account.

Can I access my cash-back earnings immediately after making a purchase?

Yes, Daily Cash is accessible the day after a qualifying purchase is made.

How can I track my spending with the Apple Card?

The app provides color-coded spending categories and a visual “spending wheel” to help users analyze their spending habits.

Does the Apple Card offer additional benefits beyond cash back?

It provides features like Apple Pay-dependent rewards, unique card design, and access to Mastercard benefits like Priceless experiences and ID theft protection.

Can I use the Apple Card for purchases outside of Apple Pay?

Yes, the physical titanium card can be used, but purchases made with it only qualify for 1% cash back.

Is the physical titanium card automatically sent upon approval?

No, users need to request the physical card separately.

Alliant Cashback Visa® Signature Credit Card

Reward Details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Card Features

- Pros & Cons

The Alliant Cashback Visa® Signature Credit Card is a high-earning card aimed at heavy spenders with good credit. Its main selling point is its flat-rate cash back rewards of 2.5 percent that can be accumulated for up to five years. What distinguishes this offer is that the cash back rate is not affected by the category or merchant. You can spend with confidence knowing that you will receive the same rewards regardless of how much you spend.

However, in order to receive the higher cashback, you must be a Tier One Rewards member and meet some specific requirements . Overall, the Alliant Visa Signature Credit Card is an excellent rewards card with a cash back rate that is difficult to beat. It's straightforward, with a sizable credit line and clear rewards. There are no complicated bonuses or categories to remember. However, there is an annual fee, so make sure you can afford it.

- APR: 17.49% – 27.49% (Variable)

- Annual fee: $99

- Balance Transfer Fee: 3%

- Foreign Transaction Fee: $0

- Rewards Plan: up to 2.5% cash back on your first $10,000 of qualifying eligible purchases (1.5% for purchases over $10,000)

- Sign Up bonus:None

- 0% APR Introductory Rate period: None

- High Rewards Rate & Sign Up Bonus

- Cashback Rewards

- Debt Protection Plan

- Fraud Protection

- Annual Fee

- Higher Cash Back Requirements

Discover it® Cash Back

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

We like the Discover it® Cash Back card due to its exceptional flexibility. With a revolving selection of high-reward categories that change every few months, this card provides an impressive 5% cashback on up to $1,500 in rotating category purchases each quarter when you activate the bonus category (then 1%), as well 1% percent cash back on all other purchases.

Beyond its flexible rewards structure, the Discover it® Cash Back features a 15 months on purchases and balance transfers and a compelling sign-up bonus. This card is particularly well-suited for individuals who have a clear understanding of their spending patterns and wish to capitalize on the elevated reward rates, as well as those planning significant purchases in the upcoming months.

- Rewards Plan: 5% cashback on up to $1,500 in rotating category purchases each quarter when you activate the bonus category (then 1%), as well 1% percent cash back on all other purchases

- APR: 17.24% – 28.24% Variable

- Annual fee: $0

- Balance Transfer Fee: 5%

- Foreign Transaction Fee: $0

- Sign Up bonus: All cash back earned at the end of the first 12 months is matched.

- 0% APR Introductory Rate period: 15 months on purchases and balance transfers

- 0% Intro APR Period

- High Cash Back for Select Spending Categories

- Matches Cash Back in the First 12 Months

- No Annual Fee

- Limit on Cash Back Spending Per Quarter

- Keeping Track of Bonus Categories

- Less Merchant Acceptance

- Balance Transfer Fee

- What are the cash-back rewards limit? There is a $1,500 cap on purchases each quarter that allows you to get the bonus cashback rates. Otherwise, no cap.

- Does Discover it Cash Back ask for proof of income? No out and out request for proof of income and no transparent income requirements.

- Does card rewards points expire? No expiry date for these points.

- Can I get pre-approved on card Discover it Cash Back? Yes, you can get pre-approval.

- What is the initial credit limit of card Discover it Cash Back Card? The minimum credit limit will be $300.

- How do I redeem cash back? You can get the rewards in the form of cash, statement credit, or gift cards.

- What purchases don't earn cash back ? All purchases will earn cashback.

- Should You Move to Discover it Cash Back Card? If you want to get good rewards from bonus categories and want access to a good signup offer.

- Why did Discover deny me? What to Do Next? You might not have met all of the requirements. You can enquire as to where your application fell short. If you cannot proceed, you can look at some of the other available options.

Understand How Cashback Credit Cards Work

What is a Cashback Rewards Credit Card?

A Cashback Rewards Credit Card is like a special kind of credit card that gives you money back for using it. Here's how it works: when you buy things with the card, the credit card company gives you a percentage of the money you spent as a reward. So, you end up getting some of your money back.

There are three main types of these cards:

Flat-rate: You get a fixed percentage of cashback on all your purchases, no matter what you buy or how much you spend.

Tiered: The amount of cashback you get depends on what you buy. For example, you might get more cashback for groceries or gas than for other stuff.

Rotating categories: At first, it's like a flat-rate card, but they also give extra cashback for specific categories that change every few months.

But here's the thing: these cards usually have limits on how much cashback you can earn. For instance, you might get 6% cashback on Amazon purchases, but only up to a certain amount, like $1,500 for the quarter.

Check The Requirements Before Apply

The bad news is, most issuers will approve cashback rewards credit cards only to those with good or excellent credit. Consumers with the best credit scores benefit more because they can get the best cashback reward programs.

If your credit score isn’t so ideal, you may not qualify for any reward credit cards. Many of the good cashback credit cards are exclusive to a “prime” credit score of at least 630 points. It would be wise to not apply for any credit cards if you have a poor credit score and you can’t pay your bills on time.

In order to avoid too many hard credit check that can decrease your score, it's recommended to make sure you're eligible before applying.

When to Consider a Cashback Rewards Card?

Cashback cards are good for you if your fit a certain cardholder profile. It’s best if you don’t carry a balance, spend at least $1,500 each month, want simplicity, and are not a fan of complex calculations.

As we said, they come in three varieties: flat-rate, tiered, and bonus category. Flat-rate cards will pay the same percentage on every purchase. Bonus category cards give a higher rate in categories that change from time to time and a flat 1% on the rest. Tiered cards give higher percentages on specific types of purchases like gas, groceries, or restaurants but 1% on others.

If your spending budget is skewed towards certain categories such as gas or groceries, a tiered or bonus category card is most appropriate. If you want to avoid the hassle of keeping track of which of your cards have bonus categories, just go for a flat-rate card

Which Factors Should You Consider?

When choosing a cash back credit card, there are a couple of factors to consider:

- Rewards & Cashback Rate

Realistically, how much cash back can you earn? Is the rate uniform across all purchases? Or does your card offer better rates for specific types of purchases? By definition, cashback should provide you with money that will add to your funds but there isn't really a hard and fast way to maximize the points or miles your earn.

What you can do is evaluate your exact earning rates concerning your habitual spending patterns. And make sure you review the extra perks that your card gives out.

Do they charge or waive foreign transaction fees? Do you get added protection for your purchases and travels? Benefits like these make your card even more valuable.

- Fees

If you can pay off your balance each month, you won't have to worry about interest charges. You can focus on improving your credit in the meantime – and then ask your card company to lower your interest rate later on.

Each card company will have its own set of charges. But there's no need to read all the fine prints from end to end to know all these charges. Most credit cards will list their most common fees in a prominent area in their marketing materials. Some of the fees worth looking into more closely are:

- Annual fee. The annual fee is what you pay for the convenience of being able to use a credit card. Some cashback rewards credit cards do not collect an annual fee.

- Balance transfer fee. You have to pay this fee when you do a balance transfer which is a transaction that lets you transfer your balance from your old card to your new one. The fee is a percentage of the balance that you are transferring and it usually runs from 3% of the transaction amount or $5, whichever is higher. So, the more balance you transfer, the higher the transfer fee you need to pay.

- Cash advance fee. You have to pay this fee when you make a cash advance or an equivalent transaction. Take note that overdraft protection and credit card convenience checks are also part of cash advance transactions.

- Foreign transaction fee. When you make a purchase in foreign currency, you will have to pay this fee. Remember that your issuer can charge you this fee wherever your location is as long as your transaction is in a currency other than U.S. dollars.

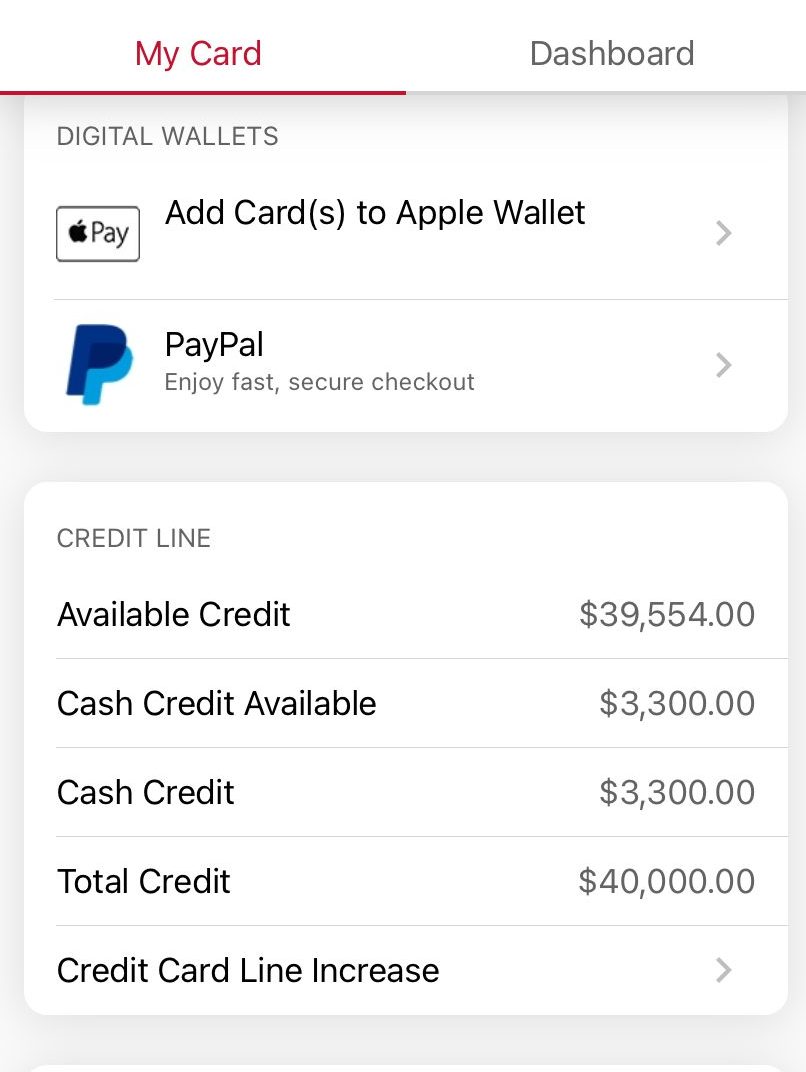

- Credit Limit

The ideal credit limit should provide you with the flexibility you need but it should not be so high that it would plunge you into credit card debt. If you are a college student, set your eyes on a low-limit card because you are just learning to use your card for the first time.

After you graduate, you can ask for a higher limit because your monthly expenses may rise. Having a higher limit would help you build your credit over time because spending a lower percentage of your credit limit every month will do wonders for your score.

But know your capacity. If you have not been very responsible with credit in the past, don’t go for a high-limit credit card because it may tempt you to take on more debt than you can comfortably handle.

- Special Perks

In addition to the pure cash back rewards, many card offer special perks that can be relevant if you're looking to get a welcome, bonus, paying off debt, plan a big purchase or getting extra protection. Here are some additional benefits offered by many credit cards:

- 0% intro APR

- Welcome bonus

- Extended Warranty

- Travel accident insurance

- Baggage insurance

- Rental car insurance

- Dining credit

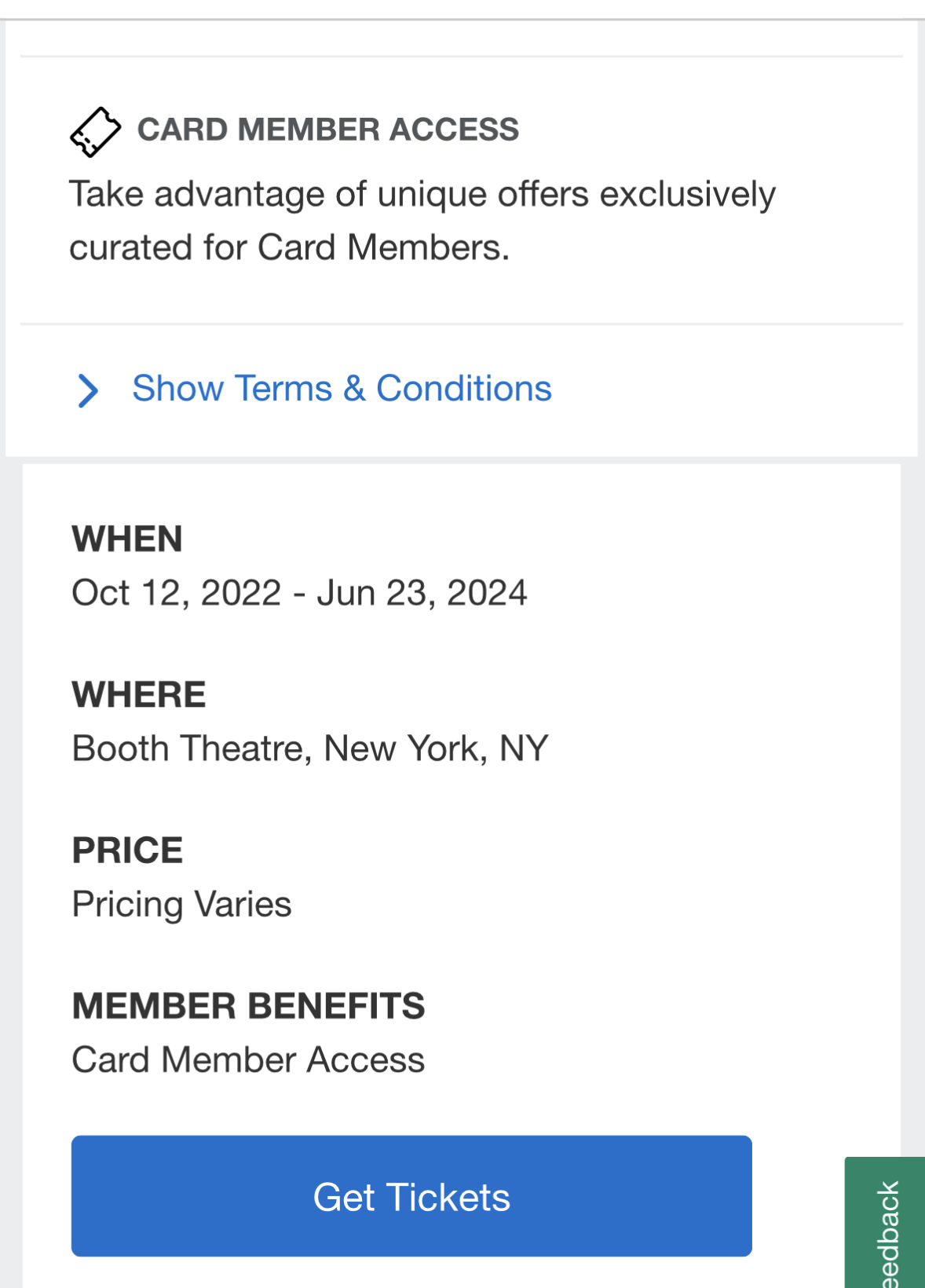

- exclusive access to ticket presales

- Travel assistance services

- Liability & fraud protection

- Vouchers for sport & culture events

- Concierge service

- $0 food delivery fee

- Premium seats in flights

- Shopping portals

- Combine cards for optimum rewards

If switching among cards to maximize your rewards is not an issue with you, get cards that complement one another’s rewards systems.

For example, you can apply for a card that offers cash back for dining, another that gives you bonuses for shopping at Amazon, and a third one that gives a premium for gas and groceries. If your cashback card categories overlap, you’ll end up with a few useless ones in your wallet.

Top Offers From Our Partners

Top Offers From Our Partners

Top Offers From Our Partners

How to Maximize Your Cashback Rewards

Maximizing your cash back benefits doesn't mean to spend more. However, you should understand how your card works, track your expenses and leverage the relevant categories. Here are some tips:

- Track how you earn cashback

The trick in getting the most of your cashback credit card and earning the most miles of points possible is in taking advantage of every available bonus opportunity. For some cards, it will require you to track your spending and using your card to pay for every purchase that will give you cashback benefits.

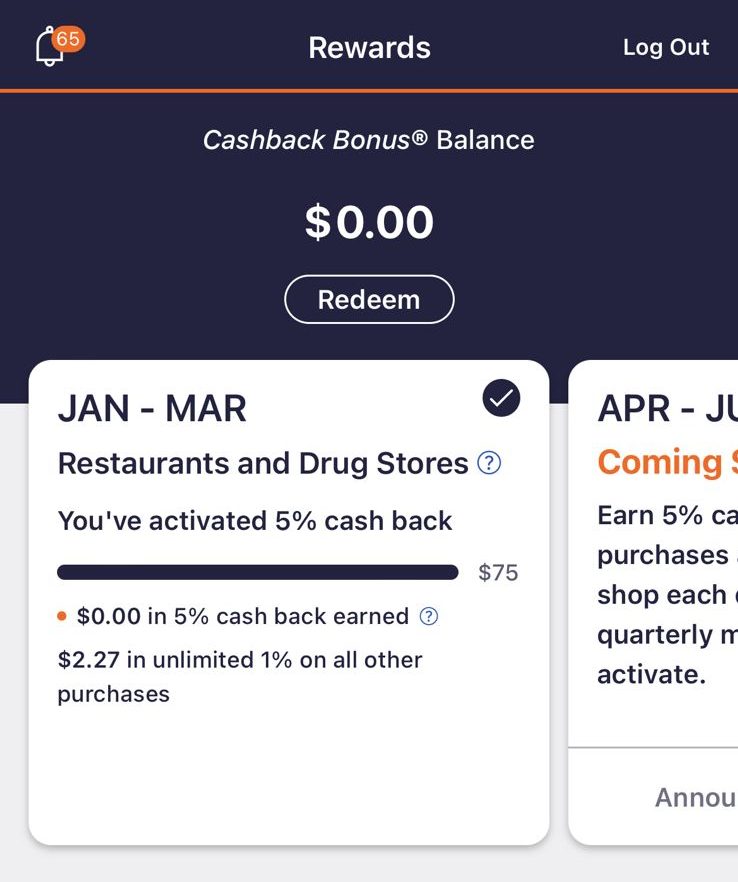

- Take advantage of rotating bonus categories

If your card offers rotating cashback bonus categories, don’t forget to activate or opt into the categories every quarter. This would entitle you to get 5% cashback on featured categories such as restaurants, gas stations, wholesale clubs, groceries, and more.

- Look for sign-up bonuses

Some cards will have bonus miles that you can get if you spend a certain amount within the first few months of opening your new credit card. These sign-up bonuses are a great tool to get momentum in your point rewards buildup.

- Shop around for the best card for your needs

You should look for a credit card whose cashback rewards fit your spending patterns. Do you have a large, hungry family? Maybe a credit card that has a cashback on groceries will be good for you. Do you drive a lot because of work? A card that offers cash back on gas would be nice. If your all-around spending is about even, a simple flat-rate cashback credit card will do the trick.

Pros & Cons Of Cash Back Cards

Pros | Cons |

|---|---|

Cash Rewards | Cashback Limits |

Additional Perks | Complex Reward Structures

|

Diversification and Simplicity | Minimum Redemption Thresholds |

Sign up Bonus Offers

|

- Cash Rewards

It is obvious what the big advantage of a cashback credit card is – you can save (even a little) on every item that you buy. This might not be a big deal now, but in some cases, they will put all these rebates together and return them to you in a single annual payment.

So, if you spend around $20,000 a year on your cashback credit card, your total annual rebate could add up to some $1,000. Some issuers would add a cash bonus if you spend a certain amount within a specific time. The additional $50 to $200 they offer means more spending money for you.

- Additional Perks

Some cash back credit cards come with additional perks such as travel insurance, extended warranties, and purchase protection. While not the primary focus, these extras can enhance the overall value of the card.

- Diversification and Simplicity

This is another important benefit of a cashback rewards card. You can get cash for all sorts of things. You can spend in almost any category, or choose the relevant categories for your lifestyle and still get cashback for your regular purchases.

Also, many cards will have a simple accumulation method that won’t require complicated computations.

- Sign up Bonus Offers

Most cashback credit cards would have sign-up bonuses that give you additional benefits when you first apply for your card.

However, they often require that you spend X amount in a set period to get the bonus points. However, it’s a simple way to give your points balance a good head start. Just make sure that the spending requirement does not mess up your budget.

- Cashback Limits

Some card companies may set a maximum amount that a cardholder can get in cashback rewards per year.

Remember that earnings in bonus categories are not automatic; there is usually an online enrollment process every quarter to qualify for them.

- Complex Reward Structures

While simplicity is a pro for many cash back cards, some may have complex reward structures with rotating categories or tiered cash back rates.

This complexity can make it challenging to optimize your rewards and may require more effort to track and understand.

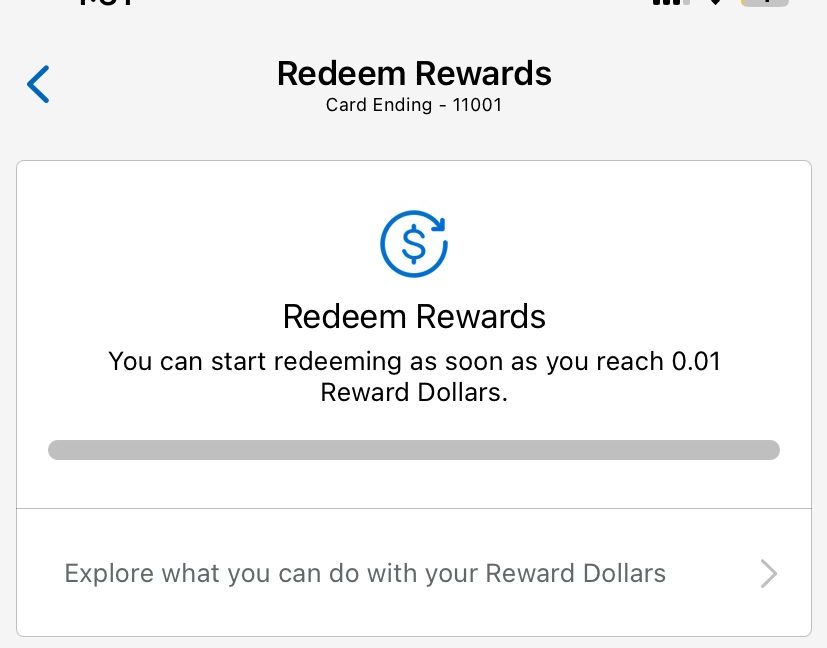

- Minimum Redemption Thresholds

Some cash back cards have minimum redemption thresholds, meaning you can only redeem your rewards once you reach a certain amount.

This can be a drawback for individuals who prefer more frequent, smaller redemptions.

Mistakes To Avoid When Choosing a Cashback Rewards Card

You'll want to avoid some behaviors that can prevent you from getting the best card for your needs:

- Not paying your bill in full at end of each month

Cashback cards are pretty worthless if you’re keeping a balance on them because they will cost you money in the long run. Every month, you will pay interest on that balance and often, the 26% APR will just eat up the 1% cashback that you’re getting.

Credit card companies know how to exploit your weakness of being a fund revolver when you rack up a balance. Try not to be weak because you’ll be sinking your money in the vaults of these bankers.

- Buying things you wouldn’t buy if you had the cash

The technique to profit from cashback credit cards is to not make unplanned purchases. Use the card to make normal, necessary everyday purchases that fit your overall budget.

- Maxing out your credit card limit

It’s always financially risky to max out your credit cards. For one, the more you charge, the more difficult it gets to pay off the balance. Even if you just use 95% of your credit limit, it may not be enough to get you out of trouble in case a sudden emergency expense crops up. Plus, maxing out your credit card increases your credit utilization ratio as well.

Your credit utilization ratio tells bankers how fast you accrue your credit card debt and a high ratio is bad for your credit score. Lenders will rather stay away from borrowers with a utilization ratio above 30%. So, if you max out all your credit cards, it’s almost a safe statement to say that you are beyond the 30% benchmark.

Bottom Line

Not all cashback cards are the same. Don’t stop at the right card for you but rather, look for the best card for your situation. Try to get one with the highest potential cashback reward value compared to other cards. If you have this data, you can make a very intelligent decision on which cash back rewards credit card you should apply for.

Top Offers From Our Partners

Top Offers From Our Partners

Top Offers From Our Partners

How We Picked The Best Cash Back Cards: Our Methodology

To find the best cash back credit cards, we researched over 30 issuers, including major banks, credit unions, and fintech companies . Independently, our experts meticulously analyzed data to generate star ratings based on four categories: cash back rewards, card features, cardholder experience, and issuer reputation. This comprehensive approach ensures a thorough evaluation of each card's value and benefits.

- Cash Back Rewards (40%): We evaluate the cash back rewards structure, including the percentage of cash back offered on purchases, any bonus categories, and redemption options. Credit cards with higher cash back percentages, versatile redemption choices, and lucrative sign-up bonuses receive higher scores.

- Card Features (30%): This category assesses the range of features provided by the credit card issuer, such as annual fees or foreign transaction fees, 0% intro APR offers, and additional perks like travel insurance or purchase protection. Cards offering valuable benefits with minimal fees and competitive introductory rates earn higher scores.

- Cardholder Experience (20%): We closely examine the ease of application, customer service quality, and online account management tools. Credit card issuers with responsive customer support, intuitive mobile apps, and streamlined application processes receive higher ratings.

- Issuer Reputation (10%): Our team scrutinizes each issuer's reputation, including customer feedback, financial stability, and regulatory standing. Issuers with a strong reputation, positive customer reviews, and a history of responsible lending practices receive the highest ratings.