Discover may focus on debt consolidation but their personal loans have many different uses such as vacation and wedding expenses.

APR

7.99% – 24.99%

Loan Amount

$2,500 – $40,000

Term

36 to 84 months

Min score

660

Discover may focus on debt consolidation but their personal loans have many different uses such as vacation and wedding expenses.

APR

7.99% – 24.99%

Loan Amount

$2,500 – $40,000

Term

36 to 84 months

Min score

660

Our Verdict

Unlike the other lenders on this list so far, Discover is one of the few companies that lend to residents of all 50 states. They also don’t charge an origination fee and have a helpful loan calculator on their website to help you get started. They have flexible repayment terms, fixed rates, and are have a staff of 100% US-based loan specialists available to help you.

You can use a Discover personal loan for various reasons, from financing a large purpose, such as home repairs or a wedding to debt consolidation. You can also use your personal loan to cover unexpected expenses, remodeling your home or purchasing a new vehicle.

The only trouble with Discover is that the application process is longer than others and they charge a pretty hefty late payment fee. They also don’t allow joint borrowers and the max amount able to be borrowed is less than many other places. The loan range for Discover is between $2,500 – $35,000 .

What It Takes to Qualify?

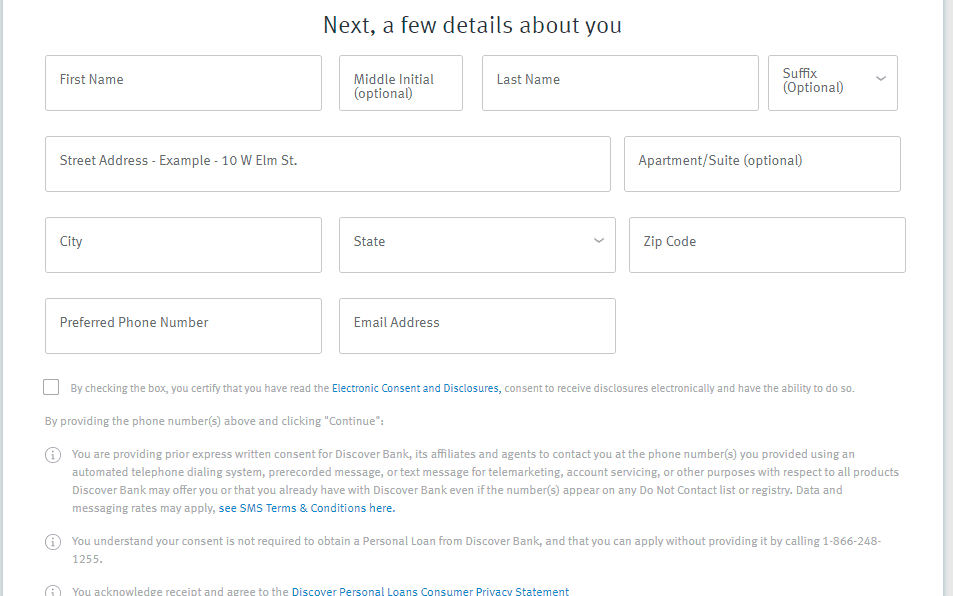

To apply for an Discover Personal Loan, applicants must meet specific requirements:

Credit Score Requirements: Minimum FICO credit score of 660 is required to qualify for a Discover personal loan.

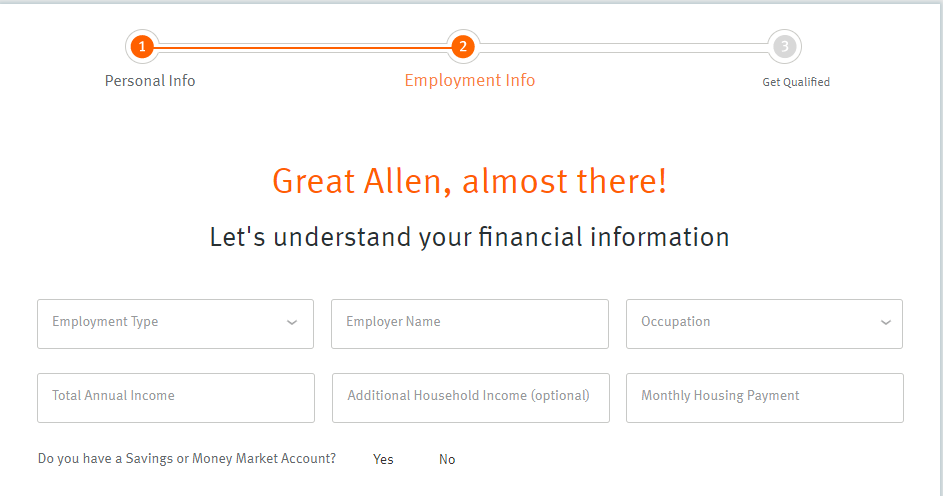

Income Requirements: Applicants must have a minimum household income of $25,000 to be considered for a loan. Verification of income, such as W-2s or pay stubs, is necessary to demonstrate the ability to repay the loan.

No Co-signers and Co-applicants: Discover personal loans are only available to individuals, so co-borrowers or co-signers are not options.

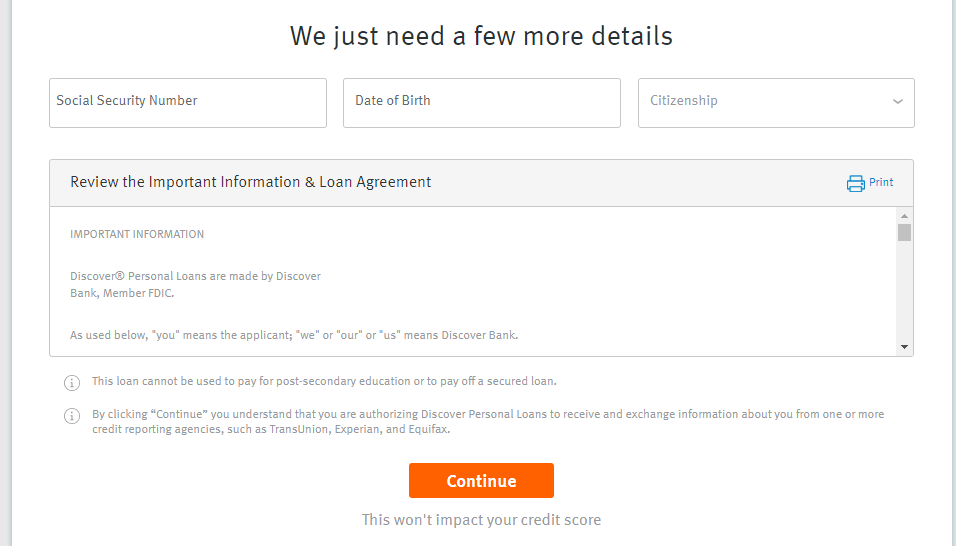

In addition to these requirements, applicants need to provide certain documentation:

Valid U.S. Social Security Number: Applicants must possess a valid U.S. Social Security number to apply for a Discover personal loan.

Employment Information: Details about employment status and history are required for the application.

Documentation for Debt Consolidation: For debt consolidation purposes, applicants must provide third-party creditor account numbers and balances as part of the application process.

Meeting these requirements and providing the necessary documentation is crucial for a successful application for an Discover Personal Loan.

Understanding Discover Repayment Options

Understanding repayment options and the consequences of missed payments can help borrowers navigate their loan journey effectively and maintain financial stability.

- Payment Options: Discover offers various payment methods, including automatic payments, online payments through the account center, phone payments, mail payments, wire transfers, and electronic bill pay through a bank.

- Missed Payment: If a payment is missed, Discover may impose a late fee of $39. It's crucial to make payments on time to avoid additional charges and potential negative impacts on credit score.

- Rescheduling Payments: Discover allows borrowers to change their payment due date up to two times during the loan repayment term, as long as the changes occur at least 12 months apart.

- Options for Payment Difficulty: If facing difficulty in making payments, borrowers should contact Discover's loan specialists to discuss available options, such as adjusting payment schedules, temporary forbearance, or exploring hardship programs

Discover Personal Loan Pros & Cons

Like all lenders, Discover has its own set of advantages and drawbacks that potential borrowers should consider:

Pros | Cons |

|---|---|

Soft Pull Inquiry | No Rate Discounts |

No Origination Fee | Smaller Max Amount |

Direct Payment to Creditors | No Joint Borrowers |

Competitive Interest Rates | Large Late Payment Fee |

Competitive Interest Rates | Late Payment Fees |

Mobile App Accessibility | |

Available in All States |

- Soft Pull Inquiry

Discover personal loans allow for an initial soft pull inquiry online so the borrower can get an idea of the options for which they may qualify.

- No Origination Fee

Discover personal loans has no origination fee and no prepayment penalties. These fees should always be considered in the cost of your loan. Many personal loan providers have large origination fees.

- Direct Payment to Creditors

Discover offers to send payments directly to creditors as part of their service. This way you know your new loan will go to pay down your current debt and not add to your overall debt.

- Competitive Interest Rates

Interest rates are competitive and rates are not as high as those of many other lenders for personal loans.

- Mobile App Accessibility

Discover's mobile app allows borrowers to manage their loan easily on-the-go, enhancing convenience and accessibility.

- Available in All States

Many personal loan providers are not licensed or available in all states.

- No Rate Discounts

Unlike some competitors, Discover doesn't offer rate discounts for enrolling in automatic payments, potentially missing out on potential savings.

- Smaller Max Amount

Discover personal loans’ max amount is smaller than many other personal loan providers.

- No Joint Borrowers

Discover does not allow for joint borrowers.

- Large Late Payment Fee

Discover personal loans have a late fee of $39, which is higher than most other providers.

Customer Experience

Customer reviews of Discover Personal Loans are mixed. While the company has a high rating on its own website, external platforms like Trustpilot and the Better Business Bureau show more varied feedback. Positive reviews often highlight the convenience of the application process and quick approval times.

However, negative reviews may mention issues with customer service, loan terms, or dissatisfaction with the overall experience.

Discover | |

|---|---|

iOS App Score | 4.9 |

Android App Score | 4.6 |

BBB Rating | A+ |

Contact Options | phone |

Availability | 24/7

|

You can reach Discover's customer service by calling their loan specialists at 866-248-1255. They are available from 8 a.m. to 11 p.m. Eastern Time on weekdays and from 9 a.m. to 6 p.m. ET on weekends. Additionally, you can contact Discover’s Customer Advocacy Group at 302-328-3300.

What Else You Should Know?

Before applying for a personal loan with Discover, it's important to understand additional factors that could impact your borrowing experience:

-

Can I get a Discover loan with a 600 credit score?

Generally speaking, you will need a 660

credit score.

However, this does not mean that you will be automatically declined if you have a score of 600. You may still qualidebt-to-income a good debt to income ratio and can meet the other requirement criteria.

-

Can I negotiate with Discover?

If you are struggling to make your repayments or want to organize your finances by making a settlement, you can call the Discover helpline.

Discover claims to be prepared to help you whether you have long-term hardship issues or a temporary financial setback. The bank has a variety of repayment assistance programs that could help you.

-

Can I pay off the Discover loan early?

Discover makes it easy to repay your personal loan early if you decide this is the best option for you.

Whether you want to pay off the entire loan early or make extra payments, this is possible, and you’ll incur no prepayment penalties or fees.

-

What is the funding time?

The funding time for Discover Personal Loans is typically quick, with approved borrowers often receiving funds as soon as the next business day after acceptance of loan terms.

This rapid funding can provide borrowers with timely access to the funds they need for various purposes, including debt consolidation, home improvements, or unexpected expenses.

-

What Happens If I miss a payment?

If you miss a payment on your Discover Personal Loan, Discover may charge a late fee of $39. Additionally, missing payments can have negative consequences on your credit score and overall financial health.

It's essential to communicate with Discover's customer service if you anticipate difficulty making a payment, as they may be able to offer assistance or alternative repayment options.

What Can a Discover Personal Loan Be Used For?

Discover Personal Loans can be used for a variety of purposes, including:

- Debt consolidation: Combining multiple debts into one loan to simplify payments and potentially lower interest rates.

- Home improvements: Funding renovations, repairs, or upgrades to your home.

- Auto repairs: Covering the costs of unexpected vehicle repairs or maintenance.

- Medical bills: Paying for medical expenses, including treatments, procedures, or prescriptions.

- Vacation expenses: Financing travel, accommodations, and other vacation-related costs.

- Wedding costs: Funding wedding ceremonies, receptions, or other related expenses.

- Adoption and fertility costs: Covering expenses associated with adoption or fertility treatments.

Overall, Discover Personal Loans offer flexibility in usage, allowing borrowers to address a wide range of financial needs and goals.

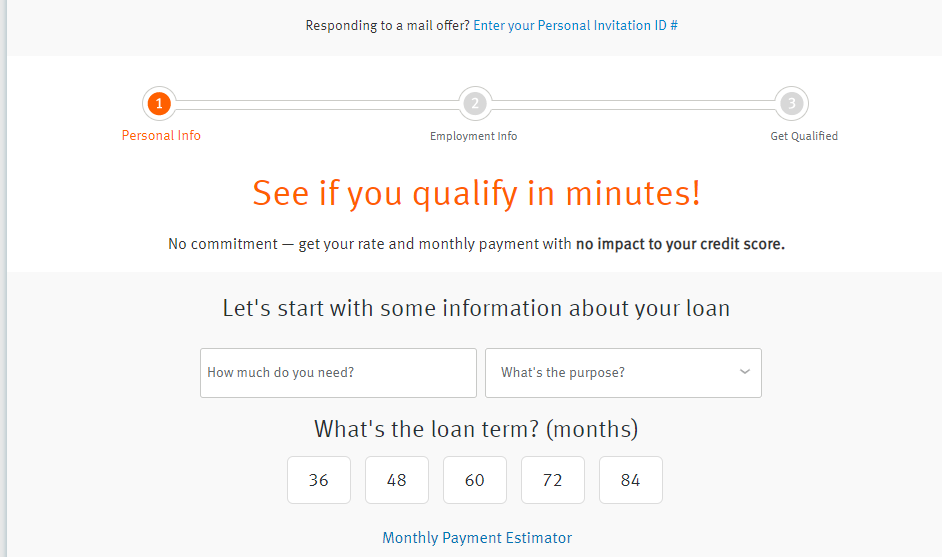

How to Apply For a Personal Loan With Discover

They have a large customer base, marketing to those who use Discover credit cards or other banking products. You do not need an invitation to apply. You can apply online or by phone.

Even if you apply online, you will have to speak to a Discover representative. You can do a soft pull online to see what kind of rate Discover will offer to you. You will need basic personal information such as income, employment and banking information.

If you are planning to consolidate debt, Discover will require creditor information, including balances and account numbers.

The application process for Discover personal loans usually takes 1 to 7 days. In some cases they will require additional information in order to verify identification and/or income.

Discover Personal Loan FAQs

Is Discover a good place to get a loan?

Discover allows customers to use loans for almost any purpose. Discover has a completely digital application process, speeding up approval. You can expect to receive the funds typically within one business day.

However, to qualify, you need an excellent credit score, so it may not be the best option for a lot of consumers. If you're still not sure, you can always keep comparing personal loan lenders ot take a look on our picks for the best personal loan for good credit.

Does Discover check your bank account?

Discover requires that applicants have a minimum household income. However, the lender does need to verify the income you specify on your application. This can be done by submitting recent bank statements, or pay stubs.

They may also contact your employer to verify your employment status. In some circumstances, Discover may use a third party, such as your bank to confirm your income information.

Is Discover better than FIGURE?

FIGURE offers larger sums for personal loans with far longer terms, making them a good choice for debt consolidation loans. The rates are also lower. Just bear in mind that if you take a loan with a longer term, even if the rate is lower, you will pay more in the long term.

According to our FIGURE personal loan review, Figure is also more flexible in terms of its lending requirements. You can qualify for a loan with a FICO score of 680, but you will need to have a debt-to-income ratio of less than 40%.

So, if you are in need of a debt consolidation loan, FIGURE does make a better option compared to Discover.

Is Discover better than Upstart?

Like FIGURE, Upstart has a higher borrowing limit compared to Discover. You can also use the loan for a variety of purposes. Another key difference is the rates, which are far higher compared to Discover.

Upstart requires a credit score of at least 600, so it is easier to qualify for a loan, but you do need to demonstrate that you have a regular income or are in full-time employment.

Upstart can also deliver approval and your funds within one day. So, if you are in need of a quick loan and don’t have a great credit rating, Upstart is likely to be the better choice.

Is RocketLoans better than Discover?

Discover offers more attractive rates compared to Rocket Loans rates. However, you do need to have excellent credit with a score of 720 or more. You can use the proceeds of the loan for almost any purpose and the application process is fully digital. Like Rocket, if you’re approved, you can expect to receive your funds in one business day.

While these are attractive terms, if you have a credit score of less than 720, Rocket Loans may be a decent alternative.

Is Citibank better than Discover?

Discover offers loans with a lower maximum and very similar rates to Citi loan. You can use the proceeds of your loan for almost any purpose. The application process is fully digital, which does speed up approval. You can expect to receive your loan funds within one business day.

However, this does come at a cost. You must have a credit score of at least 720. So, unless you have an excellent credit score, Citibank could be a better option.

Alternative Small Personal Loans to Consider

| |||

|---|---|---|---|

APR Range

The annual percentage rate (APR) is the total annual cost of borrowing money. This rate includes the interest rate as well as any additional finance charges. When you take out a personal loan, for example, you may be required to pay loan origination fees.

| 8.49% – 35.99%

| 5.20% – 35.99%

| 8.49% – 17.99%

|

Term

The term of your loan is the amount of time you have to repay it. For example, if you get a 24 months personal loan, the loan term is 24 months.

| 24 – 84 months

| 36-60 Months

| 12 – 60 months

|

Loan Amount | $1,000 – $50,000

| $1,000 – $50,000

| $600 – $50,000

|

Minimum Score | 600

| 300

| 650

|

Funding Time | Within a day of approval

| 1-2 Days

| N/A |

Review Personal Loan Top Lenders

Compare Alternative Lenders

Marcus is a Goldman Sachs offshoot who is one of the best in the business. It is best suited to people with good credit and those who want repayment flexibility. Discover is another high-quality lender known for its low origination and fats funding fees. Axos is an online bank that caters to people with excellent credit and aims to process funds quickly.

Read Full Comparison: Axos Vs Marcus Vs Discover: Which Personal Loan Suits You Best?

SoFi has a reputation for being one of the best in the business, with no fees, a wide range of loan options, and a flexible set of repayment terms.

Discover is another high-quality lender that does not charge origination fees, has a wide range of repayment options, and can provide funding the same day. This article will compare and contrast the similarities and differences between SoFi and Discover.

Read Full Comparison: SoFi Vs Discover: Which Personal Loan Suits You Best?

Over the years, Discover has earned a good reputation for not charging origination fees, offering flexible repayment options, and providing quick funding. Upgrade has been in the personal loan business for many years, serving over 500,000 customers and originating $7 billion in loans. It gives you quick access to funds as well as flexible repayment terms.

Finally, Happy Money is a financial wellness company that wants its customers to have a positive relationship with money.

Read Full Comparison: Upgrade Vs. Happy Money Vs. Discover: Which Personal Loan Suits You Best?

Discover is an online lender with a good reputation that does not charge origination fees. It also provides same-day funding and a variety of excellent repayment options. Citibank is one of the largest financial service providers in the United States today. For many years, the New York-based company has provided personal loans.

It is an excellent choice for those looking for no-fee personal loans as well as access to autopay discounts. Finally, Wells Fargo, like Citi, is a well-established financial services powerhouse in the United States. It is an excellent choice for those seeking large loans with a high degree of flexibility.

Read Full Comparison: Citi Vs Discover Vs Wells Fargo: Which Personal Loan Is Better?